|

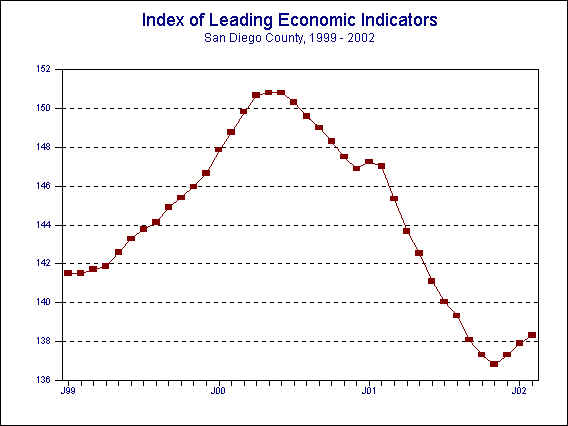

| March 27, 2002 --The University of San Diego's Index of Leading Economic Indicators for San Diego County rose 0.3 percent in February. A sharp rise in consumer confidence, supported by smaller increases in building permits and initial claims for unemployment insurance, led the Index to the upside. These gains offset a big drop in local stock prices and a smaller loss for help wanted advertising. The outlook for the national economy was unchanged for the month. |

|

|

Index of Leading Economic

Indicators The index for San Diego County that includes the components listed below (February) Source: University of San Diego |

+ 0.3 % |

|

Building Permits

Residential units authorized by building permits in San Diego County (February) Source: Construction Industry Research Board |

+ 0.13% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted (February) Source: Employment Development Department |

+ 0.83% |

|

Stock Prices San Diego Stock Exchange Index (February) Source: San Diego Daily Transcript |

- 1.03% |

|

Consumer Confidence

An index of consumer confidence in San Diego County (February) Source: San Diego Union-Tribune |

+ 2.08% |

|

Help Wanted Advertising

An index of help wanted advertising in the San Diego Union-Tribune (February) Source: Greater San Diego Chamber of Commerce |

- 0.08% |

|

National Economy

Index of Leading Economic Indicators (February) Source: The Conference Board |

+ 0.00% |

February’s increase was the third in a row for the USD Index of Leading Economic Indicators. The breadth of the advance was not very strong, as only two components with up significantly as opposed to one that was down. The other three components were unchanged or nearly so. Nevertheless, economists usually look for three consecutive changes in a leading index as signal of a turning point in an economy. The move is in line with the previous forecast for a rebound in San Diego’s economy in the second half of 2002. The outlook is for continued slowing in the first half of the year, with the unemployment rate hovering in the high 3% to 4% range. That should fall back into the low 3% range by the end of the year as the local economy strengthens.

Highlights: While residential units authorized by building permits were slightly higher on a month-to-month basis, they are down more than 10% from a year-to-year standpoint. In a reversal of 2001, multi-family residential units are up while single-family units are down. . . The labor market components were mixed. Initial claims for unemployment insurance fell from the five-year high level recorded in January, indicating that the rate of job loss has slowed. On the other side of the labor market, help wanted advertising fell for the twelfth consecutive month, although the percentage change was much less than in recent months. These two factors combined to produce an unemployment rate of 3.7% for San Diego County for February. This is down from January’s mark of 4.1%, but nearly a full percentage point above the 2.8% unemployment rate for February 2001. . . Local stock prices dropped sharply in February, reflecting a difficult month for small-to-medium sized publicly traded companies. The Nasdaq Composite Index fell by more than 10% during the month. . . Local consumer confidence continues to surge. In February, it reached its highest level since December 2000. . . The national Index of Leading Economic Indicators was unchanged in February after increasing for four months in a row. A number of reports continue to paint an improving picture for the national economy in areas such as manufacturing, consumer confidence, and unemployment. In fact, there is some concern that this will put upward pressure on interest rates. My view is that some rough spots remain ahead for the national economy, and that a full recovery will not take place until the summer. That should provide a boost to the local economy, which finds itself more tied than ever to the fate of the U.S. economy.

February's decrease puts the Index of Leading Economic Indicators for San Diego County at 138.3, up from January’s reading of 137.9. The values for the Index of Leading Economic Indicators for San Diego County for the last year are given below:

| Index | % Change | ||

| 2001 | FEB | 147.0 | -0.2% |

| MAR | 145.3 | -1.1% | |

| APR | 143.7 | -1.2% | |

| MAY | 142.5 | -0.8% | |

| JUN | 141.1 | -1.0% | |

| JUL | 140.0 | -0.7% | |

| AUG | 139.3 | -0.5% | |

| SEP | 138.1 | -0.9% | |

| OCT | 137.3 | -0.5% | |

| NOV | 136.8 | -0.4% | |

| DEC | 137.3 | +0.4% | |

| 2002 | JAN | 137.9 | +0.4% |

| FEB | 138.3 | +0.3% |

For more information on the University of San Diego's Index of Leading Economic Indicators, please contact:

| Professor Alan Gin

School of Business Administration University of San Diego 5998 Alcalá Park San Diego, CA 92110 |

TEL: (619) 260-4883 FAX: (619) 501-2954 E-mail: agin@home.com |