|

Home

Leading Economic Indicators

Up in August

Note:

The

tentative release date for next month's report is October 27.

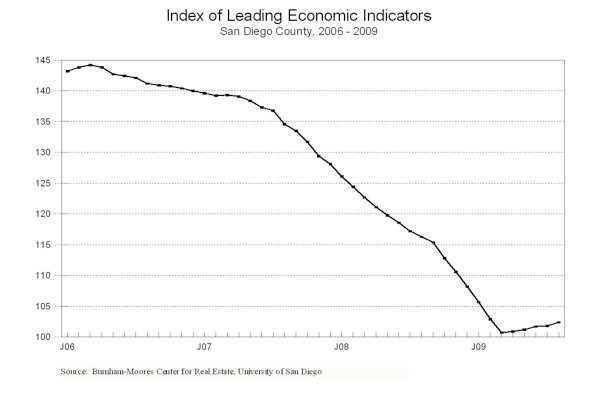

September 24, 2009 -- The University of San Diego's Index of

Leading Economic Indicators for San Diego County rose 0.6 percent in August. As has

been the case for the previous four months. a sharp gain in local consumer

confidence led the move to the upside. Also advancing solidly were local stock prices and the outlook for the

national economy. These gains

outpaced big negative moves in building permits and initial claims for

unemployment insurance and a smaller drop in help wanted advertising to push the

USD Index to its fifth straight increase.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (August)

Source: University of San Diego |

+ 0.6 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (August)

Source: Construction Industry Research

Board |

- 1.47% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (August)

Source: Employment Development Department |

- 1.21% |

|

Stock Prices

San Diego Stock Exchange Index (August)

Source: San Diego Daily Transcript |

+ 0.77% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (August)

Source: San Diego Union-Tribune |

+ 4.92% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (August)

Source: Monster Worldwide |

- 0.52% |

|

National Economy

Index of Leading Economic Indicators (August)

Source: The Conference Board |

+1.17% |

August's

gain was the biggest monthly gain in the USD Index since March 2004. It reinforces the view projected since the Index first turned positive

that the local economy is approaching a bottom. The breadth of the advance remains mixed, with the number of rising

components matched by the number of decliners. This month's

numbers are encouraging in that the components that were negative were down by

smaller amounts than have recently been this case. A key in the coming months will be whether the local economy can

stabilize as the summer ends and we head into the slower fall and winter months. Back-to-school sales have already been classified as weak, and not much

improvement is expected in the holiday buying season. As was indicated in previous reports, it looks like a bottom is more

likely in the first half of 2010 than in the latter part of 2009.

Highlights:

Residential units authorized by building permits in August were the third

worst on record, with only January and February of this year being lower.

Of the 102 units authorized, only four with multi-family units, which

tied the worst level ever for a single month.

With housing sales picking up and inventory dropping, there is a concern

about a possible bottleneck in residential construction as many developers have

either scaled back their operations considerably or have left the region

entirely. . . Both labor market variables remain negative, but are "less

bad" than in recent months. Job loss

continues to be high, with initial claims for unemployment insurance

remaining well above the 30,000 level. Although it was not enough to change the negative trend in initial

claims, August's

level was down 10 percent from the all-time high set in July. Help wanted advertising was down for the 36th month in

a row, but it was the smallest decrease since October 2006. The net result was that the local unemployment rate was a high 10.4

percent in August, but was unchanged from the previous month. . . Local

consumer confidence surged as consumers' views of the present situation and their expectations both rebounded sharply,

with the former reaching a 13-month high and the latter reaching a 28-month

high. . . The gain in August put

local stock prices up 40 percent from the March 9 low as the financial

markets remain positive about the outlook for San Diego companies. . . The national Index of Leading Economic Indicators has now

increased for five months in a row, implying a rebound in the national economy

is on the way. Many economists,

including the Federal Reserve Chairman, think the national recession is now

over, with the Gross Domestic Product (GDP) likely to turn positive in the

current (3rd) quarter.

August's

decrease puts the USD Index of Leading Economic Indicators for San Diego County at 102.4, up from July's

revised reading of 101.8. Revisions in building permits for July and in the national Index of Leading Economic

Indicators for April through July affected the change in the USD Index for July

and its level for June and July. Please visit the Website address given below to see the revised changes for the

individual components. The values

for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|