|

B. Sources of Comparative Advantage

1. Factor endowments

- Ricardo assumed labor was the only factor of

production

- Heckscher-Ohlin Theory - comparative

advantage explained by differences in resource endowments

- Also known as Factor Endowment Theory

Ex. - Brazil (coffee), U.S. (wheat)

a. Assumptions

- Same demand (tastes and preferences)

- Factor inputs uniform in quality

.

b. Consequences

- Relative prices differ because countries have

different endowments of factor inputs

- Different commodities require different

combinations of factor inputs

- Country will have comparative advantage in

and export commodity where a large amount of the relatively abundant

input is used

- Country will import commodity where

relatively scarce input is used

.

.

.

.

.

.

.

.

- Relative abundance means relative

(opportunity) cost is less

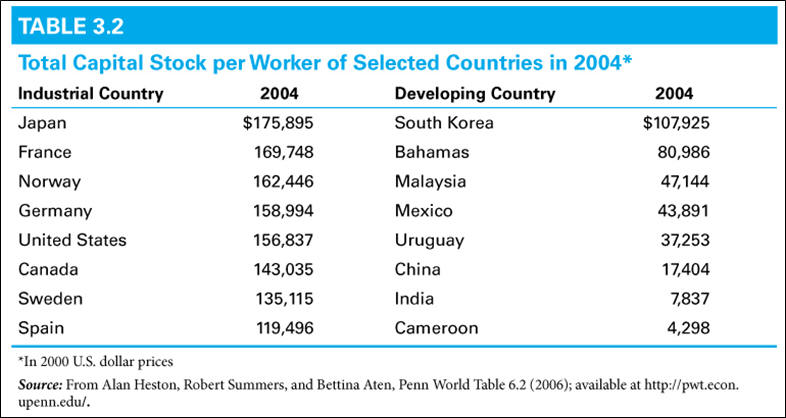

- Capital stock per worker:

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c. Factor price equalization

- Trade alters the mix of factors used in

production

.

.

.

.

.

.

.

.

.

.

- Trade leads to equalization of relative

factor prices

- Demand increases for abundant factor =>

price of factor increases

- Demand decreases for scarce factor => price

of factor decreases

Ex. - Auto industry

.

- Labor is not identical - differences in

human capital

- Different technology used

- Transportation costs and trades barriers

prevent equalization

.

d. Empirical evidence

- Leontief paradox - U.S. exporting

industries have lower capital/labor ratio than import-competing

industries

- Need to look at subvarieties of inputs, e.g.,

skilled vs. unskilled labor

- Human capital an important consideratio

.

2. Distribution of income

- Could get worse even while overall income is

increasing

- If skilled workers are abundant, increased

demand increases wages

- Demand for low-skilled workers decreases

.

- Increase in price of goods increases income earned by

resources that are used intensively in its production

- Decrease in price of goods reduces the income of the

resources that it uses less intensively

- Magnification effect - change

in the price of resource is greater than change in the price of good that uses

the resource intensively

.

- Is trade bad for unskilled workers?

- International trade and technological change

increases demand for skilled workers relative to unskilled workers

- Immigration decreases supply of skilled

workers relative to unskilled workers

- Education and training increases supply of

skilled workers relative to unskilled workers

.

.

.

.

.

.

.

.

.

.

a. Immigration

- Increase size of labor force

- Few low-skill jobs native Americans unwilling to do

- Bring jobs that contribute to technological innovation

.

- Take away jobs from Americans

- Suppress domestic wages

- Consume public services

.

b. Specific factors theory

-

Workers acquire skills for specific occupations, not

easily transferrable

-

Resources specific to import-competing industries lose as

a result of trade

-

Resources specific to export industries gain as a result

of trade

.

3. Skill as a source of comparative advantage

.

4. Increasing returns to scale and

specialization

- "New trade theory" - returns to scale added to

theory of comparative advantage, not to replace it

- Nations with similar factor endowments may still

trade to take advantage of economies of scale

.

.

.

.

.

.

.

.

.

.

- Home market effect - countries specialize

in products that have a large domestic demand

- Minimize transportation cost and achieve

economies of scale

.

- Average cost for firm decreases as output for the industry

expands in an area

- Due to pools of specialized workers, spread of knowledge

.

- Small market areas may deindustrialize, become

suppliers of commodities

.

5. Overlapping demands

- Linder - domestic demand key determinant for

trade in manufactured goods

- Greatest export potential in markets with similar

tastes and incomes

- High income - demand high quality manufactured

goods (luxuries)

- Low income - demand low quality manufactured

goods (necessities)

- Wealthy nations will trade with wealthy nations,

poor with poor

- Unequal income distribution means some demands

overlap between wealth and poor countries - some poor in wealthy

countries, some wealthy in poor countries

- Evidence supports for wealthy countries, less so

for developing countries

.

6. Miscellaneous issues

a. Intraindustry trade

- Interindustry trade - trade of different

products between different countries

- Due to interindustry specialization -

countries focus on different industries where they have advantages

- Intraindustry specialization - focus on

particular products within a given industry

Ex. - Automobiles, semiconductors

.

- Intradindustry trade - two-way trade in a

similar commodity

Ex. - Automobiles, computers

.

(1) Homogeneous products

(a) Geography and transportation costs

Ex. - U.S. and Canada

.

(b) Seasonality

Ex. - Northern vs. Southern Hemisphere

.

(2) Differentiated products

(a) Minority tastes

Ex. - U.S. cars in Japan

.

(b) Overlapping demand segments

Ex. - Luxury cars to high-income

buyers

.

(c) Economies of scale

- Economies of scale achieved by

specializing in subcategories

.

b. Business services

Ex. - Tourism, construction, banking, finance,

insurance, medical and legal services

- Comparative advantage applies

- Heterogeneous => need to look at

subcategories

- Human and physical capital (communications,

technology) endowments determine advantage

.

7. Product life cycle theory

- Technological innovation a key determinant of

trade patterns

(1)

Manufactured good is introduced to home market

- Small market

- Technological uncertainty

(2) Domestic industry shows export strength

- Exports to markets with similar tastes and

income levels

(3) Foreign production begins

- Locate closer to foreign market

- Reduce production costs

(4) Domestic industry loses competitive advantage

- Foreign imitation as technology becomes more

commonplace

(5) Import competition begins

- Production process becomes standardized

.

8. Government policy

a. Dynamic comparative advantage

- Industrial policy - government

attempts to create comparative advantage

Ex. - Japan

-

Target emerging ("sunrise") industries, e.g.,

high tech

- Anti-trust immunity

- Tax incentives

- R&D subsidies

- Loan guarantees

- Low interest loans

- Trade protection

- Need cooperation by government, business, and

labor

.

(1) Pros

- Allows country to expand into higher

productivity industries

.

(2) Cons

- Some industries successful without

government help

- Increased trade restrictions could result

- Free market could achieve a better result

.

b. Government regulatory policies

- Workplace safety (Occupational Safety and

Health Administration), product safety (Consumer Product Safety

Commission), clean

environment (Environmental Protection Agency)

- Increases cost of production

.

.

.

.

.

.

.

.

.

.

- Tradeoff: domestic companies hurt, more

trade vs. higher quality of life

- Other domestic industries may benefit, e.g.,

forest products

.

9. Transportation costs

- Transportation costs - costs of moving goods, freight

charges, packing and handling expenses, insurance premiums

- Obstacle to trade - could impede realization of gains

from trade

a. Trade effects

- Without transportation costs

.

.

.

.

.

.

.

.

.

.

- With transportation costs

.

.

.

.

.

.

.

.

.

.

b. Impact of transportation costs

- Reduce degree of specialization

- Allow

factor price differentials (wages) to persist

.

c. Transportation costs decreasing

- Transportation costs as percent of imports:

1965 = 10%, 2000 = 4%

- Economy less transportation intensive -

finished products more important now than raw materials

- Improved transportation productivity

(technology)

- Large dry-bulk containers

|