|

D. Urban Housing and Public Policy

1. Unique characteristics of housing

- Housing differs from other products

a. Housing is

durable

-

Has longer life than most commodities -

deteriorates over time, but at slow rate

-

Can provide housing

services for decades

.

b. Housing stock is heterogeneous

- Each dwelling offers a

different bundle of housing services

- Dwelling

characteristics - size, layout, quality,

interior design, structural integrity

- Location is part of

housing bundle

- Site characteristics -

accessibility, local public services and

taxes, environmental quality, appearance

of neighborhoods

.

.

.

.

.

c. Housing is the most important means of

wealth accumulation for many households

.

2. Filtering

- If maintained, housing can provide services

for decades

- Will deteriorate if not maintained

- Filtering - housing moves from one quality

level to another (usually downward)

.

a. Stock of high

vs. low quality housing

.

.

.

.

.

.

b. Impact of price changes

.

.

.

.

.

.

.

.

.

.

c. Supply of high and low quality housing

(1) High quality housing

.

.

.

.

.

.

.

.

.

.

(2) Low quality housing

.

.

.

.

.

.

.

.

.

.

d. Impact of limit on building permits

(1) High

quality market

.

.

.

.

.

.

.

.

.

.

(2) Low quality market

.

.

.

.

.

.

.

.

.

.

e. Gentrification

.

.

.

.

.

.

.

.

.

.

3. Housing policy

a. Housing conditions

- Inadequate - incomplete plumbing

or kitchen, structural problems, unsafe heating or electrical

systems

- Crowded - more than one person per

room

- Cost burdened - more than 30% of

income spent on housing

.

| 2015 |

All |

Poor |

Renters |

Black |

| Severely inadequate plumbing, heating,

electric |

1.3% |

3.0% |

1.9% |

2.3% |

| Crowded |

2.1% |

5.6% |

3.9% |

2.4% |

| Cost-burdened |

32.7% |

74.9% |

48.8% |

43.8% |

- Neighborhood conditions - junk, abandoned buildings, crime, rundown

buildings, noise

.

b. Supply-side policies

- Increase supply of housing for low-income

households

.

(1) Public housing

- Built and managed by local government

- Federal involvement - capital

and operating subsidies ($6.4 billion in 2012), tenant selection (< 80%

of median income in area)

- 1.1 million households lived in public

housing in 2012

.

(a) Efficiency

- Value of public housing is two-thirds

of subsidy

- More expensive than private housing

- Private sector can build new housing more efficiently than

public sector

- Plentiful supply of used low-quality

housing.

- Production efficiency = market

value / production cost = 0.50 for public housing

.

(b) Living conditions

- Lower income => more crime

- Units abandoned, taken over by drug

abusers and gangs

- Layout (high-rise buildings) lead to

sociological problems - high density, difficult to

supervise

- Low-rise buildings better, more

costly

.

(2) Subsidies for private housing

construction

(a)

Project-based rental assistance program

-

Section 8 - Project Based

-

Government specifies maximum rent

that can be charged to an eligible household, covers gap

between market rent and tenant contribution

-

$9.4 billion in 2012 for 1.2 million

households

-

Ex. -

.

.

.

(b) Tax credits for low-income housing

-

20/50 set

asides - at least 20% of rental

dwellings occupied by households with less than 50% of median

area income

-

9 percent tax credit for project cost

related to low-income housing

-

Maximum rent = 30% of qualifying income

- Each dollar spent produces $0.62 worth of housing

.

(3) Market impacts

.

.

.

.

.

.

.

.

.

.

-

Reduction in price "crowds out" unsubsidized

housing

-

More retirement of housing, less downward

filtering

-

Crowding out estimated to be 1/3 to 1/2

.

.

c. Demand-side policies

- Give subsidies to poor, let them choose

housing

(1) Housing vouchers

- Section 8 Tenant Based Rental

Assistance

- $19.2 billion for 2.2 million households

in 2012

(a) Income standards

- Must have income < 80% of area

median

- Bulk to very poor (< 50% of area

median)

.

(b) Dwelling must

meet minimum standard, cannot spend more than fair market

rent (45th percentile of rent)

.

(c) Government pays difference between

actual rent and 30% of eligible household's income

- Face value = Fair market rent - 0.30 *

Income

Ex. -

.

.

.

- Recipient can spend more than fair

market rent on housing

.

(d) Market effect

.

.

.

.

.

.

.

.

.

.

- Price driven up for non-recipients

- Voucher equivalent to income, more

utility

- Allows tenants to occupy inexpensive used

housing => more housing per budget $

- Taxpayers seem to support public housing

rather than voucher, care more about housing consumption than

utility

.

(2) Subsidies for mortgage interest

- Increasing marginal tax rate

- More itemizing of deductions as income

increases

- Housing is a normal good - more housing

consumed as income increases

.

.

.

.

.

.

.

.

.

.

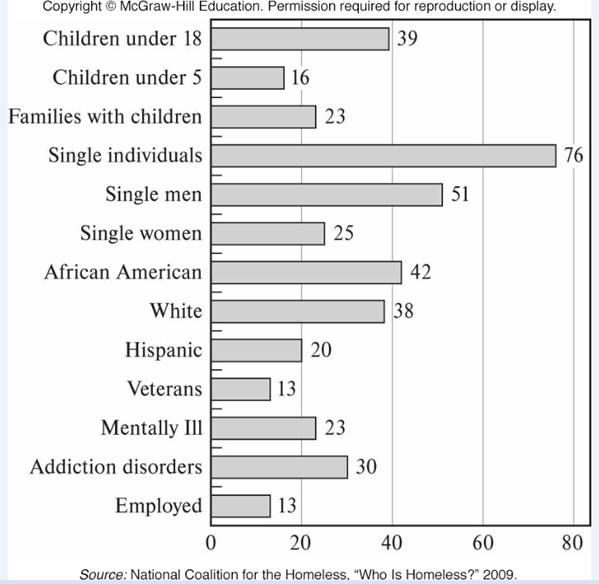

d. Homelessness

.

- a supervised public or private shelter designed

to provide temporary living accommodations

- an institution that provides temporary

residence for individuals intended to be institutionalized

- a place not intended to be used as a regular

sleeping place

.

(1) Characteristics of the homeless

population

.

(2) Causes of homelessness

(a) Relatively high prices for low-quality

housing

.

(b) Weak labor markets, slow employment

growth

(c) Low institutionalization rates for the

mentally ill

.

(3) Policies to deal with homelessness

(a) Improve functioning of low end of

housing market

(b) Continuum of care (CoC) model

(c) Housing-first approach

|