|

E.

Aggregate Model of the Macro Economy

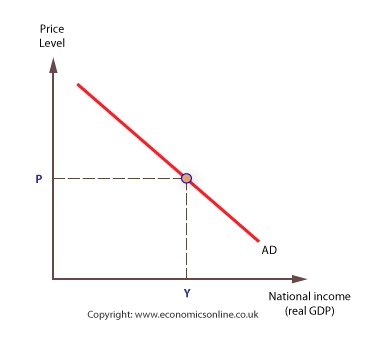

1. Aggregate demand curve

-

Shows combinations of the price level

(P) and real income or GDP (Y) that result in simultaneous

equilibriums in both the goods and money markets

-

Based on the different types of expenditures (C,

I, G, and X - M)

a. Graph

b. Shifting the aggregate demand curve

.

(1) Factors affecting the

aggregate demand curve

C = f [TP(-), r (-), CC

(+), W (+), CR (+), DB (-)]

I = f [r (-), TB(-), PR

(+), CU (+)] G = f [G (+)]

(X - M) = f [Y* (+), R (-)] .

AD = f [TP(-), r (-), CC (+), W (+), CR (+), DB (-), TB(-),

PR (+), CU (+), G, Y* (+), R (-)]

.

(2) Monetary policy

MS increases => r decreases => C, I

increases => AD increases MS

decreases => r increases => C, I decreases => AD decreases .

(3) Fiscal policy

G increases => AD increases

G decreases => AD decreases .

TP increases => C decreases

=> AD decreases TP

decreases => C increases => AD increases .

TB increases => I decreases

=> AD decreases TB

decreases => I increases => AD increases .

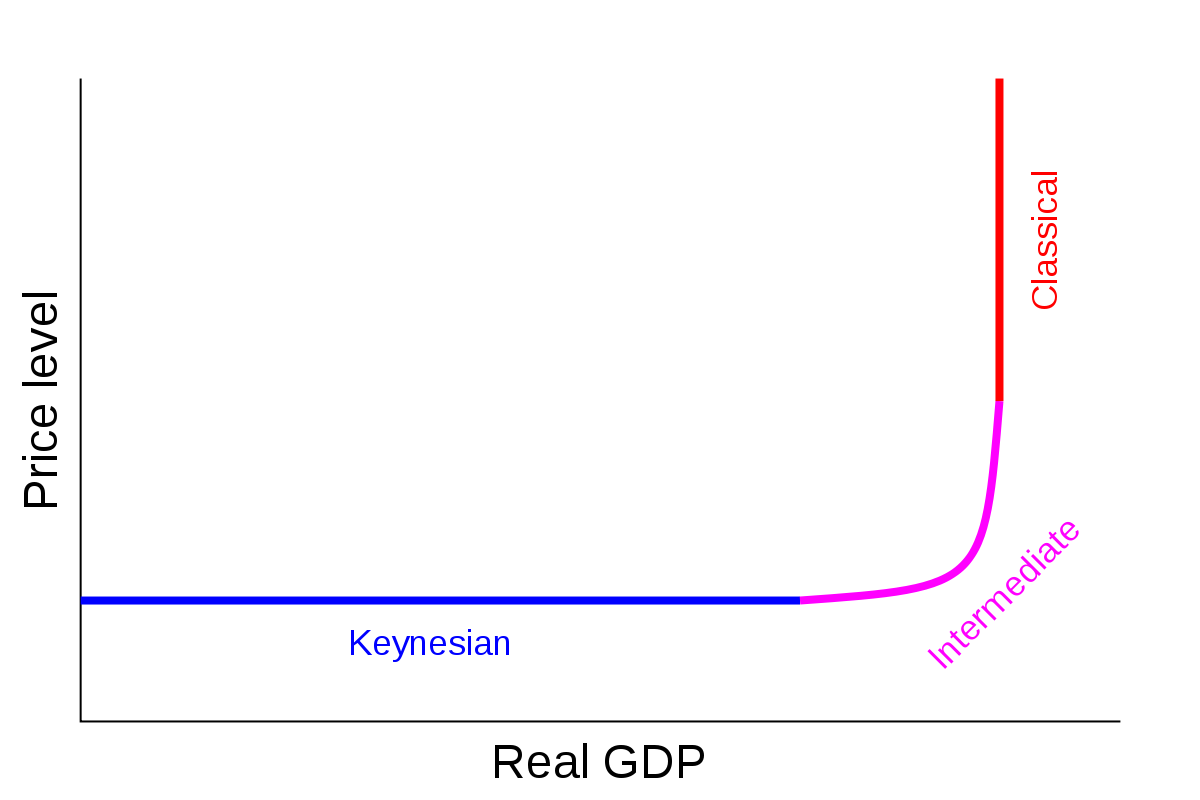

2. Aggregate supply curve

-

Shows the price level at which firms are

willing to produce different amounts of real goods and

services

-

Depends on quantity and quality of resources used in

production, efficiency with which resources are used, and

production technology

.

a. Short-run aggregate supply

-

Amount of resources, efficiency of their

use, and level of technology constant in short-run

-

Affected only by changes in the prices of

inputs

.

.

b. Long-run aggregate supply

-

Potential output - full-employment level of

output

-

Maximum amount that can be produced, given

resources and technology available

. .

.

3. Equilibrium

.

.

.

.

.

.

.

.

.

.

4. Changes

a. Aggregate demand

.

.

.

.

.

.

.

.

.

.

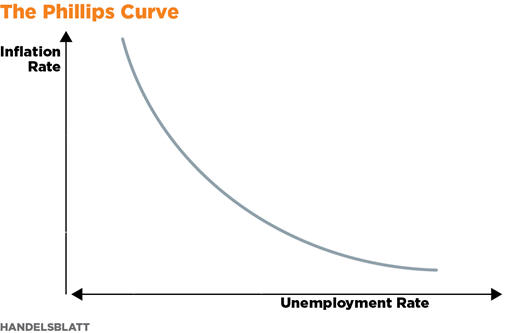

(1) Phillips curve

.

(2) Using policy to affect the

economy

(a) Monetary policy

.

.

.

.

.

.

.

.

.

.

- Depends on responsiveness of

expenditures to changes in interest rates

.

.

.

.

.

.

.

.

.

.

(b) Fiscal policy

-

To counteract a downturn:

increase government expenditures, decrease taxes

-

To counteract overheating:

decrease government expenditures, increase taxes

.

.

.

.

.

.

.

.

.

.

- Deficit if government expenditures >

government revenue

- Debt = accumulated deficits

- Are deficits and debt a problem?

i) Crowding out

.

.

.

.

.

.

.

.

.

.

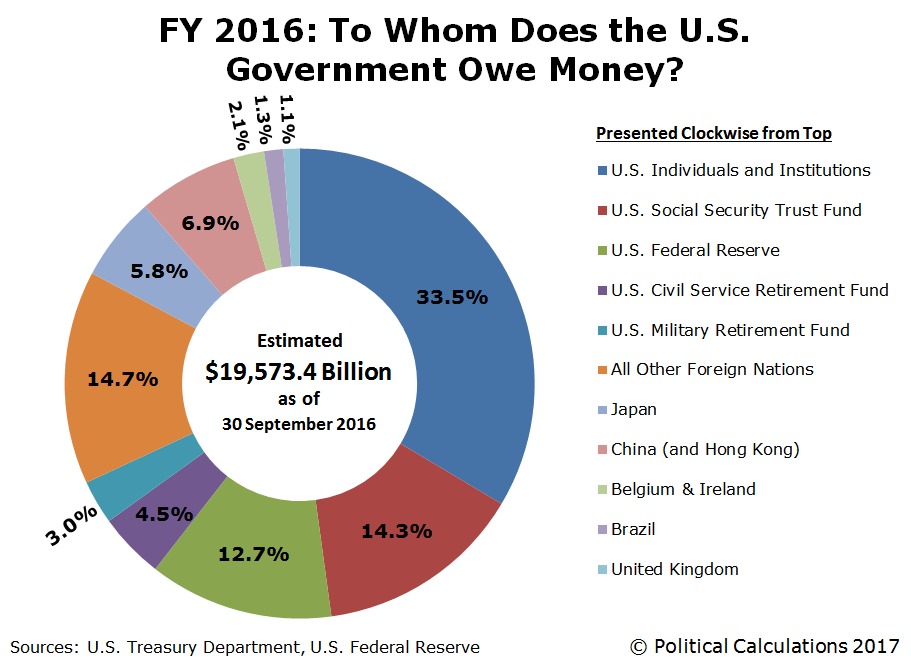

ii) Who owns the debt?

.

iii) Is the debt a burden on

future generations?

.

(c) Lags

- Recognize problem

- Implement policy

- Have impact on problem

-

Recognition lag similar for both

monetary and fiscal policy

-

Implementation lag longer with

fiscal policy - need to pass legislation, implement legislation

-

Impact lag longer with monetary

policy - indirect impact on economy

.

b. Short-run aggregate supply

.

.

.

.

.

.

.

.

.

.

.

c. Long-run aggregate supply

.

.

.

.

.

.

.

.

.

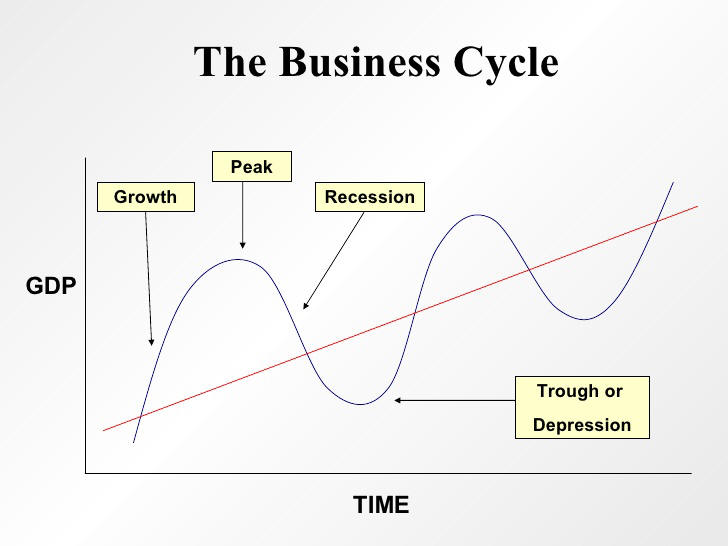

5. Business cycle

.

a. Economic indicators

(1) Concurrent indicators

- Employees on

nonagricultural payrolls

- Personal income less transfers

-

Industrial production

-

Manufacturing and trade sales

.

(2) Leading indicators

- Average weekly hours,

manufacturing

-

Average weekly initial claims for

unemployment insurance

-

Manufacturer's new orders, consumer goods and

materials

-

Institute for Supply Management new orders

index

- Manufacturer's new orders,

nondefense capital goods excluding aircraft

-

Building permits, new private housing units

-

Stock prices, 500 common stocks

-

Leading Credit Index

-

Interest rate spread, 10-year Treasury bond

less federal funds

-

Average consumer expectations for business

and economic conditions

.

(3) Lagging

indicators

- Average

duration of unemployment

- Inventories to sales ratio,

manufacturing and trade

- Labor cost per unit of output,

manufacturing

- Average prime rate

- Commercial and industrial loans

- Consumer installment credit to

personal income ratio

- Consumer price index for services

-

Calculated by the

Conference

Board

.

b. Impact on managerial decisions

|