FUNDAMENTALS OF BUSINESS ECONOMICS

|

| Summer 2011 |

|

Graduate (S) Business Administration 503 FUNDAMENTALS OF BUSINESS ECONOMICS |

|

|

|

| | HOME | SYLLABUS | CALENDAR | ASSIGNMENTS | ABOUT PROF. GIN | |

|

B. Fiscal Policy 1. Government spending and taxation

.

2. Budget deficits

- Capital expenditures counted completely in year of expenditure - Cash flow statement . .

a. Borrowing to finance deficits

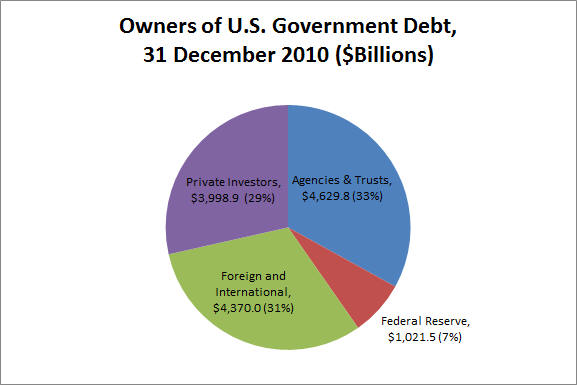

. b. Ownership of the debt

c. Deficits and the interest rate . . . . . . . . . .

d. Impact on real goods market . . . . . . . . . 3. Fiscal policy

a. Recessions

. . . . . . . . b. Inflationary expansions

. . . . . . . . . c. Lags

(1) Recognition lag - takes time to recognize that a problem exists

(2) Implementation lag - takes time to take action (pass legislation)

(3) Impact lag - takes time for policy to have an impact

. 4. Problems with deficits and debt

a. Measures (1) Real per capita debt

(2) Debt-to-GDP ratio

. b. Issues (1) Do government debts have to be repaid?

.  |