|

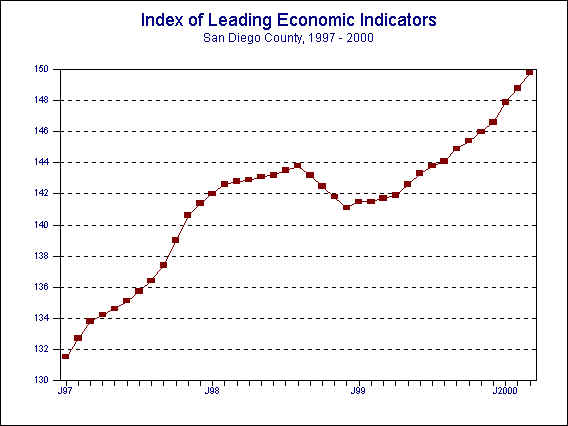

May 23, 2000 --The University of San Diego's Index of Leading Economic Indicators for San Diego County rose 0.7 percent in March. As was the case in the previous two months, big increases in local stock prices and help wanted advertising helped fuel the advance. Initial claims for unemployment insurance and building permits also posted solid gains, while the outlook for the national economy improved slightly. The only negative component was consumer confidence, which was down slightly during the month.

|

Index of Leading Economic

Indicators The index for San Diego County that includes the components listed below (March) Source: University of San Diego |

+ 0.7 % |

|

Building Permits

Residential units authorized by building permits in San Diego County (March) Source: Construction Industry Research Board |

+ 0.55% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted (March) Source: Employment Development Department |

+ 0.74% |

|

Stock Prices San Diego Stock Exchange Index (March) Source: San Diego Daily Transcript |

+ 1.44% |

|

Consumer Confidence

An index of consumer confidence in San Diego County (March) Source: San Diego Union-Tribune |

- 0.28% |

|

Help Wanted Advertising

An index of help wanted advertising in the San Diego Union-Tribune (March) Source: Greater San Diego Chamber of Commerce |

+ 1.54% |

|

National Economy

Index of Leading Economic Indicators (March) Source: The Conference Board |

+ 0.16% |

With March’s gain, the USD Index of Leading Economic Indicators has now increased for 13 months in a row. The first quarter of 2000 was very strong, with each month’s gain being larger than in any month in 1998 or 1999. The breadth of the advance improved in March compared to February, with five of the six components of the Index up during the month. Therefore, the outlook continues to be for strong growth in the local economy, now likely through the end of 2000.

In terms of the individual components, one positive development was the turnaround in building permits, which increased in March after being down for five consecutive months. A total of 1,964 residential units were authorized during the month, which is the largest number since March 1991. The total was boosted by the authorization of two apartment projects totaling 990 units, which will provide some help to the very tight rental housing market. A key question in the coming months will whether the strong local housing market will be adversely affected by the recent increases in interest rates.

On the downside, consumer confidence registered its first decrease in seven months. A strong labor market and strong stock market have given a boost to consumer confidence in recent months. While the labor market remains strong, stocks reached a peak in March and began to experience tremendous volatility to the downside. The volatility has continued since, and combined with the recent increases in interest rates, could have further negative consequences for consumer confidence. This in turn would have repercussions for the local economy, as consumer spending typically accounts for about two-thirds of the activity in an economy.

March's gain puts the Index of Leading Economic Indicators for San Diego County at 149.8, up from February’s reading of 148.8. There were no revisions to any of the previously reported values for February. The fluctuations of the Index of Leading Economic Indicators for San Diego County for the last year are given below:

| Index | % Change | ||

| 1999 | MAR | 141.7 | +0.2% |

| APR | 141.9 | +0.1% | |

| MAY | 142.6 | +0.5% | |

| JUN | 143.3 | +0.5% | |

| JUL | 143.8 | +0.3% | |

| AUG | 144.1 | +0.3% | |

| SEP | 144.9 | +0.5% | |

| OCT | 145.4 | +0.3% | |

| NOV | 146.0 | +0.4% | |

| DEC | 146.6 | +0.5% | |

| 2000 | JAN | 147.9 | +0.8% |

| FEB | 148.8 | +0.6% | |

| MAR | 149.8 | +0.7% |

For more information on the University of San Diego's Index of Leading Economic Indicators, please contact:

| Professor Alan Gin

School of Business Administration University of San Diego 5998 Alcalá Park San Diego, CA 92110 |

TEL: (619) 260-4883 FAX: (619) 501-2954 E-mail: agin@home.com |

The Index of Leading Economic Indicators is published by USD’s Real Estate Institute (REI). For more information about the REI, please contact Mark Riedy at (619) 260-4872.