|

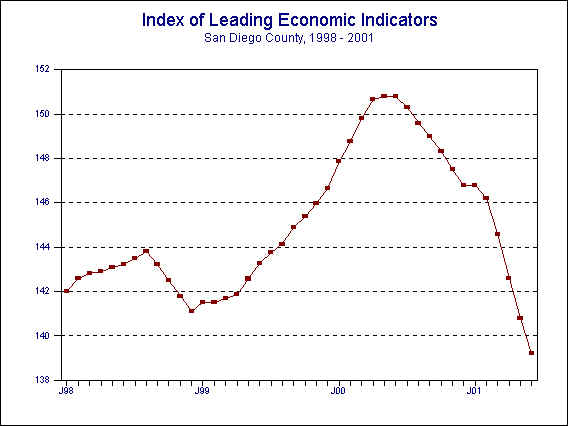

| August 14, 2001 --The University of San Diego's Index of Leading Economic Indicators for San Diego County fell 1.1 percent in June. Three of the components--consumer confidence, initial claims for unemployment insurance, and help wanted advertising–were down sharply during the month. Two others–building permits and local stock prices–experienced more moderate losses. For the third month in a row, the outlook for the national economy was the only positive indicator. |

|

|

Index of Leading Economic

Indicators The index for San Diego County that includes the components listed below (June) Source: University of San Diego |

- 1.1 % |

|

Building Permits

Residential units authorized by building permits in San Diego County (June) Source: Construction Industry Research Board |

- 0.66% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted (June) Source: Employment Development Department |

- 1.82% |

|

Stock Prices San Diego Stock Exchange Index (June) Source: San Diego Daily Transcript |

- 0.59% |

|

Consumer Confidence

An index of consumer confidence in San Diego County (June) Source: San Diego Union-Tribune |

- 2.35% |

|

Help Wanted Advertising

An index of help wanted advertising in the San Diego Union-Tribune (June) Source: Greater San Diego Chamber of Commerce |

- 1.75% |

|

National Economy

Index of Leading Economic Indicators (June) Source: The Conference Board |

+ 0.49% |

The decline in June’s decline was the fifth straight monthly decrease in the USD Index of Leading Economic Indicators, which has now fallen or remained unchanged for 13 consecutive months. The breadth of the decline remains strongly negative, with five of the six components down in the month. All of this is occurring in a cloudy economic environment for national, state, and local economies. On the negative side, the national economy continues to slow, with GDP growth of only 0.7% in the second quarter of 2001. Corporate profits are down, layoffs are up, and UCLA is forecasting a recession in California starting in the second half of the year. On the positive side, unemployment at the national, state, and local levels remains low, and the situation in California has improved considerably in term compared to the spring, when there were considerable worries about the reliability of electricity during the summer months and gasoline prices threatened to hit the $3 a gallon level. Given these cross currents, the outlook for San Diego continues to be for a slower pace of economic growth through the end of 2001 and into the first half of 2002.

Highlights: For the first half of 2001, residential units authorized by building permits are down 10.33% compared to the same period in 2000. While the number of permits for single-family homes are almost exactly the same for the two years, permits for multi-family units are down almost 25% from a year ago. . . The labor market components continue to be weak, with initial claims for unemployment insurance and help wanted advertising remaining sharply negative. The county’s unemployment rate has edged above the 3% mark with a reading of 3.3% for July, although the increase is largely due to seasonal factors. . . Local stock prices continue to be affected by the instability in the overall stock market, as investors are concerned about the impact of a slowing economy on corporate earnings. . . For the fifth month in a row, the decline in the Index has been led by a sharp decrease in consumer confidence. It remains to be seen whether positive developments on the energy front–no blackouts and lower gas prices–will turn this component around. . . The national Index of Leading Economic Indicators has now increased for three months in a row, which may indicate that the national economy will pull out of its doldrums. This the first time that the national index has increased for three consecutive months since October-November-December of 1999.

June's decrease puts the Index of Leading Economic Indicators for San Diego County at 139.2, down from May’s reading of 140.8. The fluctuations of the Index of Leading Economic Indicators for San Diego County for the last year are given below:

| Index | % Change | ||

| 2000 | JUN | 150.8 | +0.0% |

| JUL | 150.3 | -0.3% | |

| AUG | 149.6 | -0.5% | |

| SEP | 149.0 | -0.4% | |

| OCT | 148.3 | -0.5% | |

| NOV | 147.5 | -0.6% | |

| DEC | 146.8 | -0.4% | |

| 2001 | JAN | 146.8 | +0.0% |

| FEB | 146.2 | -0.4% | |

| MAR | 144.6 | -1.2% | |

| APR | 142.6 | -1.4% | |

| MAY | 140.8 | -1.3% | |

| JUN | 139.2 | -1.1% |

For more information on the University of San Diego's Index of Leading Economic Indicators, please contact:

| Professor Alan Gin

School of Business Administration University of San Diego 5998 Alcalá Park San Diego, CA 92110 |

TEL: (619) 260-4883 FAX: (619) 501-2954 E-mail: agin@home.com |