|

Home

Leading Economic Indicators

Down Slightly in August

October

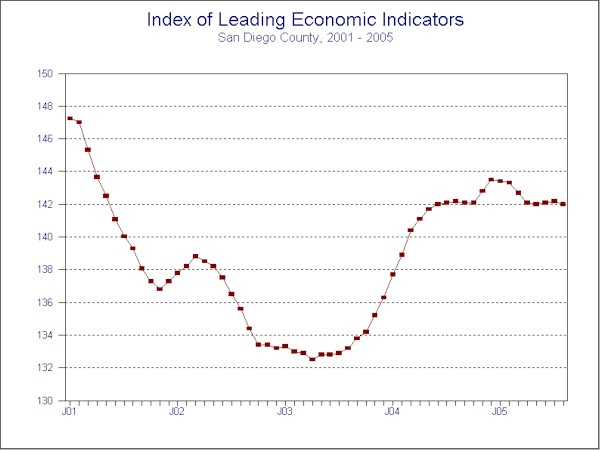

6, 2005 -- The University of San Diego's Index of Leading Economic Indicators

for San Diego County fell 0.1% in August, reversing a similarly sized gain in

July. Like July, four

components--building permits, consumer confidence, help wanted advertising, and

the outlook for the national economy--were down in August, although none of the

declines was particularly steep. On

the positive side, initial claims for unemployment insurance showed significant

strength, and there was a slight rise in local stock prices.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (August)

Source: University of San Diego |

- 0.1 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (August)

Source: Construction Industry Research

Board

|

- 0.29% |

|

Unemployment Insurance

Initial claims for unemployment insurance

in San Diego County, inverted (August)

Source: Employment Development Department |

+ 0.93% |

|

Stock Prices

San Diego Stock Exchange Index (August)

Source: San Diego Daily Transcript |

+ 0.07% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (August)

Source: San Diego Union-Tribune |

- 0.42% |

|

Help Wanted Advertising

An index of help wanted advertising in the

San Diego Union-Tribune (August)

Source: San Diego Union-Tribune |

- 0.56% |

|

National Economy

Index of Leading Economic Indicators (August)

Source: The Conference Board |

- 0.42% |

August's

small decrease broke a modest two-month upturn in the USD Index of Leading Economic

Indicators. The Index has flattened

out in the last four months, with only small changes

in either direction. The

outlook for the local economy is for continued modest growth through the end of

the year and into the first half of 2006. Potential

trouble spots continue to be the slowing of the housing market, softness in the

national economy, and the uncertainty surrounding the city of San Diego fiscal

crisis.

Highlights: Residential units authorized by building permits are

projected to top 17,000 for 2005, down just slightly from the number for 2004.

The trend seen in the first half of the year continues, with multifamily

units authorized up significantly and single family units down. . . The labor

market variables remain mixed. Initial

claims for unemployment insurance have declined significantly over the last

four months, which is a positive for the Index.

On the other hand, help wanted advertising declined each month

over that same period. The net

result was that the local unemployment rate was 4.3% in August, which was down

from 4.4% in July. . . Local stock prices matched the overall market

trends by increasing in July and bucked them with a modest gain in August. . .

The trend for consumer confidence remains negative.

The moving average for that component has now dropped for eight

consecutive months, although the pace of the decline is slackening a bit.

This mirrors the trend at the national level, where high gas prices, the

conflict in Iraq, and concerns about the response to Hurricane Katrina appears

to have damaged the national psyche. . . The outlook for the national economy

remains cloudy. After a sharp gain

in June, the national Index of Leading Economic Indicators was down in

both July and August. Some of the

factors weighing negatively against the national economy are high oil and

gasoline prices, rising short-term interest rates, and the fallout from the

hurricanes that hit the Gulf Coast.

August's decrease puts the Index of Leading Economic Indicators for San Diego

County at 142.0, down from July's reading of 142.2.

There have been some revisions to the data going all the way back to the

beginning of the year. Please visit

the Index of Leading Economic Indicators Website at the address below to get the

values for the revised components. The

values for the Index of Leading Economic Indicators for San Diego County for the

last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|