|

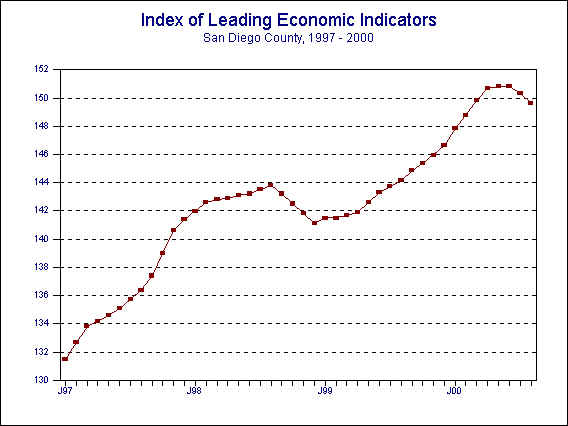

October 12, 2000 --The University of San Diego's Index of Leading Economic Indicators for San Diego County fell 0.5 percent in August. All six components of the Index were down during the month. The sharpest drop was in consumer confidence, while the declines in the other five components were relatively modest. This was the first time since September 1991 that all six of the components dropped in a month.

|

Index of Leading Economic

Indicators The index for San Diego County that includes the components listed below (August) Source: University of San Diego |

- 0.5 % |

|

Building Permits

Residential units authorized by building permits in San Diego County (August) Source: Construction Industry Research Board |

- 0.36% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted (August) Source: Employment Development Department |

- 0.27% |

|

Stock Prices San Diego Stock Exchange Index (August) Source: San Diego Daily Transcript |

- 0.48% |

|

Consumer Confidence

An index of consumer confidence in San Diego County (August) Source: San Diego Union-Tribune |

- 1.29% |

|

Help Wanted Advertising

An index of help wanted advertising in the San Diego Union-Tribune (August) Source: Greater San Diego Chamber of Commerce |

- 0.28% |

|

National Economy

Index of Leading Economic Indicators (August) Source: The Conference Board |

- 0.16% |

August's drop in the USD Index of Leading Economic Indicators was the second in a row after 18 consecutive months of increasing or unchanged readings. As was the case in July, the decline was broad but not deep. All six of the components were down, but only consumer confidence was down significantly. The outlook remains for a slowing in the growth of the local economy sometime in the first half of 2001.

As was the case in July, the biggest problem for the Index in August was the continuing decline in consumer confidence, which has now dropped for six months in a row. The same factors mentioned last month–high electricity and gas prices, volatility in the stock market, etc.–continue to plague local consumers. A positive note is that the data for August does not reflect the impact of the cap on electricity rates that was passed by the state legislature in September. That should lead to an improvement in the numbers for consumer confidence in the months ahead.

Another reason for optimism in the face of a negative situation is that some of the components are declining from relatively high levels. For example, the total number of residential units authorized by building permits so far in 2000 is only slightly behind the pace of 1999, which was the best year since 1990. A similar situation exists when examining initial claims for unemployment insurance. Initial claims have increased in recent months, which is a negative for the Index. But those increases have been off of a 13-year low in initial claims that was recorded in April of this year. On a year-to-year basis, initial claims are lower in 2000 than at the same time in 1999.

August's decrease puts the Index of Leading Economic Indicators for San Diego County at 149.6, down from July's reading of 150.3. The national Index of Leading Economic Indicators was revised upward in June, but that did not change in local Index for that month. The fluctuations of the Index of Leading Economic Indicators for San Diego County for the last year are given below:

| Index | % Change | ||

| 1999 | AUG | 144.1 | +0.3% |

| SEP | 144.9 | +0.5% | |

| OCT | 145.4 | +0.3% | |

| NOV | 146.0 | +0.4% | |

| DEC | 146.6 | +0.5% | |

| 2000 | JAN | 147.9 | +0.8% |

| FEB | 148.8 | +0.6% | |

| MAR | 149.8 | +0.7% | |

| APR | 150.7 | +0.6% | |

| MAY | 150.8 | +0.1% | |

| JUN | 150.8 | +0.0% | |

| JUL | 150.3 | -0.3% | |

| AUG | 149.6 | -0.5% |

For more information on the University of San Diego's Index of Leading Economic Indicators, please contact:

| Professor Alan Gin

School of Business Administration University of San Diego 5998 Alcalá Park San Diego, CA 92110 |

TEL: (619) 260-4883 FAX: (619) 501-2954 E-mail: agin@home.com |

The Index of Leading Economic Indicators is published by USD’s Real Estate Institute (REI). For more information about the REI, please contact Mark Riedy at (619) 260-4872.