|

Home

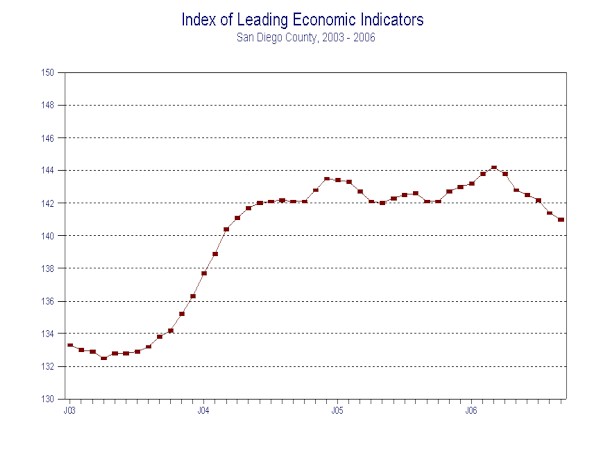

Leading Economic Indicators

Down in September

November

10, 2006 --The University of San Diego's Index of Leading Economic Indicators

for San Diego County fell 0.6 percent in September. Three components -- building

permits, initial claims for unemployment insurance, and help wanted advertising

-- were negative during the month, with the first two down sharply. Local stock

prices, consumer confidence, and the outlook for the national economy were

positive, but only slightly so.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (September)

Source: University of San Diego |

- 0.3 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (September)

Source: Construction Industry Research

Board |

- 1.04% |

|

Unemployment Insurance

Initial claims for unemployment insurance

in San Diego County, inverted (September)

Source: Employment Development Department |

- 1.36% |

|

Stock Prices

San Diego Stock Exchange Index (September)

Source: San Diego Daily Transcript |

+ 0.42% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (September)

Source: San Diego Union-Tribune |

+ 0.09% |

|

Help Wanted Advertising

An index of print and online help wanted advertising in

San Diego (September)

Source: Monster Worldwide, San Diego Union-Tribune |

- 0.17% |

|

National Economy

Index of Leading Economic Indicators (September)

Source: The Conference Board |

+ 0.28% |

With September's decrease, the USD Index of

Leading Economic Indicators has now fallen for six months in a row.

One positive development was that the number of advancing components to

declining ones was even at three apiece. This

was the first time that the ratio had not been negative since the Index began

its slide in the spring. As previously indicated in this space, job growth is

expected to cool considerably in the year ahead.

Other areas that will feel the impact of this slowing will be the housing

market, where prices and sales are expected to remain weak for most of the 2007,

and in retail sales.

Highlights:

Residential units authorized by building permits continued

to slide as homebuilders reacted to the weak housing market by reducing

construction activity. Residential

units authorized through the end of the third

quarter of 2006 were down 32 percent compared to the same period in 2005.

Single-family units authorized bore the brunt of the decline, having

dropped more than 40 percent compared to last year.

Multi-family units authorized were down a smaller but still significant

22 percent. . . The labor market variables remain weak.

Initial claims for unemployment insurance rose for the sixth

straight month, albeit from historically low levels.

On the hiring side of the job market, help wanted advertising fell

in September as online advertising

pulled back after a strong increase in August. The weakest sector for online

advertising was food preparation and serving due to the ending of the summer

tourism season. There is not enough data yet on online advertising to do

seasonal adjustment at this point. Despite

the weakness in the labor market variables, the local unemployment rate fell

below the 4 percent mark to finish at 3.9 percent for September. . .

Falling gas prices gave local consumer confidence a boost in

September as prices fell below $3 a gallon for the first time in months. . . Local

stock prices finally joined the rally in stocks that saw the Dow Jones

Industrial Average hitting new

highs. This illustrates that much of the current stock market rally has been in

the large capitalization companies represented by the Dow more than in the

smaller capitalization stocks of the Nasdaq, where many

San Diego

companies are listed. . . The news on the

national economy was mixed, with the national Index of Leading Economic

Indicators edging up slightly in September.

At the same time, initial estimates showed that the Gross Domestic

Product (GDP) grew at an anemic 1.6 percent rate in for the third quarter of

2006.

September’s

increase puts the Index of Leading Economic Indicators for

San Diego

County

at 141.0, down from August’s reading of

141.4. There were no revisions in

any of the previously reported data. The values for the Index of Leading

Economic Indicators for

San Diego

County

for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|