|

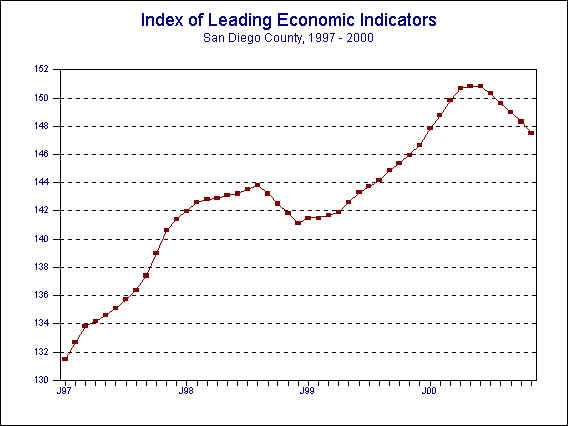

January 5, 2001 --The University of San Diego's Index of Leading Economic Indicators for San Diego County fell 0.5 percent in November. As was the case in October, a sharp drop in local stock prices led the move to the downside. Consumer confidence and help wanted advertising were also down moderately, while building permits and the outlook for the national economy decreased by smaller percentages. Initial claims for unemployment insurance declined slightly during the month, which registers as a positive for the Index.

|

Index of Leading Economic

Indicators The index for San Diego County that includes the components listed below (November) Source: University of San Diego |

- 0.5 % |

|

Building Permits

Residential units authorized by building permits in San Diego County (November) Source: Construction Industry Research Board |

- 0.34% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted (November) Source: Employment Development Department |

+ 0.28% |

|

Stock Prices San Diego Stock Exchange Index (November) Source: San Diego Daily Transcript |

- 1.34% |

|

Consumer Confidence

An index of consumer confidence in San Diego County (November) Source: San Diego Union-Tribune |

- 0.83% |

|

Help Wanted Advertising

An index of help wanted advertising in the San Diego Union-Tribune (November) Source: Greater San Diego Chamber of Commerce |

- 0.73% |

|

National Economy

Index of Leading Economic Indicators (November) Source: The Conference Board |

- 0.33% |

With November’s decline, the USD Index of Leading Economic Indicators has now fallen for five months in a row. In all five months, the decline has been broad, with at least five of the six components negative in each of those months. The outlook for 2001 remains positive overall, but the local economy could experience some turbulence during the middle of the year. This is similar to the outlook for the national economy, where a forecast by UCLA indicates a 60% probability of a recession starting in the second quarter of 2001. The recent cuts in interest rates by the Federal Reserve will likely reduce this probability and cushion the impact if a national recession does occur. It is unlikely that these cuts in interest rates are the last this year by the Federal Reserve; another 0.50% decrease in interest rates is expected by the end of 2001.

The sharp decline in local stock prices continues to put a strong drag on the Index for San Diego. 2000 was not a good year for stocks in general and technology stocks in particular, with the Nasdaq Composite Index down almost 40% for the year, its first yearly loss since 1994. This decline has negative implications for the future of the local economy in a number of ways: (1) It indicates that the financial markets are concerned with the future prospects of San Diego-based companies; (2) it will affect some firms in terms of their ability to obtain capital through stock offerings; and (3) individuals have seen their wealth reduced substantially. Many have credited a "wealth effect" due to rising stock prices with fueling the expansion of the economy. It is possible that a "negative wealth effect" due to falling stock prices will adversely affect the local economy in areas such as consumption and housing. This might be reflected in the decline in consumer confidence locally, which was the second big drag on the Index in 2001. That component was also likely affected by sharp increases in energy costs and a very tight local housing market. The drop in consumer confidence is a concern because of the large role that consumption plays in any economy, including the local one.

November's decrease puts the Index of Leading Economic Indicators for San Diego County at 147.5, down from October’s revised reading of 148.3. Revisions in the building permit data from July on led to a revision of the previously reported change for September, and in the Index levels for September and October. The fluctuations of the Index of Leading Economic Indicators for San Diego County for the last year are given below:

| Index | % Change | ||

| 1999 | NOV | 146.0 | +0.4% |

| DEC | 146.6 | +0.5% | |

| 2000 | JAN | 147.9 | +0.8% |

| FEB | 148.8 | +0.6% | |

| MAR | 149.8 | +0.7% | |

| APR | 150.7 | +0.6% | |

| MAY | 150.8 | +0.1% | |

| JUN | 150.8 | +0.0% | |

| JUL | 150.3 | -0.3% | |

| AUG | 149.6 | -0.5% | |

| SEP | 149.0 | -0.4% | |

| OCT | 148.3 | -0.5% | |

| NOV | 147.5 | -0.5% |

For more information on the University of San Diego's Index of Leading Economic Indicators, please contact:

| Professor Alan Gin

School of Business Administration University of San Diego 5998 Alcalá Park San Diego, CA 92110 |

TEL: (619) 260-4883 FAX: (619) 501-2954 E-mail: agin@home.com |

The Index of Leading Economic Indicators is published by USD’s Real Estate Institute (REI). For more information about the REI, please contact Mark Riedy at (619) 260-4872.