|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (December)

Source: University of San Diego |

- 1.0 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (December)

Source: Construction Industry Research

Board |

+ 0.74% |

|

Unemployment Insurance

Initial claims for unemployment insurance

in San Diego County, inverted (December)

Source: Employment Development Department |

- 0.87% |

|

Stock Prices

San Diego Stock Exchange Index (December)

Source: San Diego Daily Transcript |

-0.08% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (December)

Source: San Diego Union-Tribune |

- 2.61% |

|

Help Wanted Advertising

An index of print and online help wanted advertising in

San Diego (December)

Source: Monster Worldwide, San Diego Union-Tribune |

- 2.58% |

|

National Economy

Index of Leading Economic Indicators (December)

Source: The Conference Board |

-0.43% |

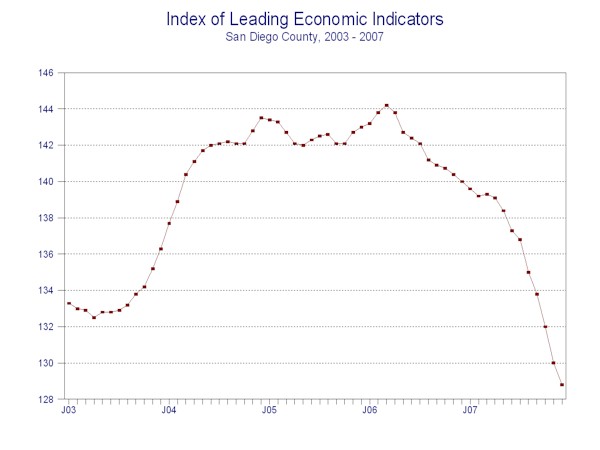

December=s

decline was the fourth large drop (one percent or more) in the last five months,

and the Index has now fallen in 20 of the last 21 months.

Although the local economy is not in a recession in the sense that there

has been a loss of jobs or a drop in Gross Regional Product,

economic activity has slowed

considerably. Initial data for 2007

shows an increase of 10,700 jobs for the year, compared to a gain of 17,800 jobs

in 2006, and the unemployment rate is approaching 5 percent.

Combined with slow housing sales and a surge in foreclosures, we are

probably in the San Diego-equivalent of a recession at this point.

That weakness is expected to continue for most of 2008, with a projected

job gain of only 5,000 - 8,000 for the year.

Highlights:

Despite a gain in December, residential units authorized by building permits

declined by 31 percent in 2007 compared to 2006.

Both single-family units (down 26 percent) and multi-family units (down

35 percent) were hurt by the slump. . . The labor market variables continue to

be weak, with both initial claims for unemployment insurance and help

wanted advertising in long and

deep slides. The net impact was that

the local unemployment rate edged up to 4.9 percent in December, a sharp rise

from the 3.7 percent unemployment rate in December 2006. . . Local consumer

confidence fell for the eighth month in a row as bad news about the housing

market and foreclosures dominated the news.

Local consumer confidence finished the year down almost 22 percent . . .

Although the stock market has slumped considerably in January, local

stock prices were off just slightly in December. . . The national Index

of Leading Economic Indicators fell for the third straight month in

December. Economists consider three

consecutive monthly changes in one direction as a sign of a potential turning

point in the economy, so this suggests a possible downturn in the national

economy. One sign of this is that

the growth rate of GDP was an anemic 0.6 percent in the fourth quarter compared

to 4.9 percent in the third quarter.

December=s

decrease puts the USD Index of Leading Economic Indicators for

San Diego County

at 128.8, down from November=s

reading of 130.0. Revisions in building permits, initial claims for unemployment

insurance and the national Index of Leading Economic Indicators impacted the

value of the Index and the monthly changes for every month going back to July.

Please visit the Website address given below to see the revised changes

for the individual components. The

values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact: