|

Home

Leading Economic Indicators

Down Slightly in April

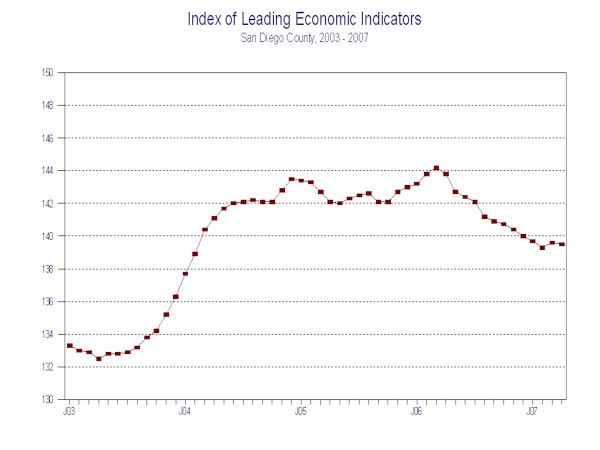

June 7, 2007 -- The

University of San Diego's Index of Leading Economic Indicators for San Diego

County fell 0.1 percent in April after falling 0.3 percent in February and

rising 0.2 percent in March. Leading the way to the downside in April were big

drops in help wanted advertising and the outlook for the national economy.

Building permits were also down, but to a lesser extent. The big gainer for the

month was local stock prices, while initial claims for unemployment insurance

and consumer confidence were moderately positive.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (April)

Source: University of San Diego |

- 0.1 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (April)

Source: Construction Industry Research

Board |

- 0.49% |

|

Unemployment Insurance

Initial claims for unemployment insurance

in San Diego County, inverted (April)

Source: Employment Development Department |

+ 0.46% |

|

Stock Prices

San Diego Stock Exchange Index (April)

Source: San Diego Daily Transcript |

+ 1.12% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (April)

Source: San Diego Union-Tribune |

+ 0.52% |

|

Help Wanted Advertising

An index of print and online help wanted advertising in

San Diego (April)

Source: Monster Worldwide, San Diego Union-Tribune |

- 0.90% |

|

National Economy

Index of Leading Economic Indicators (April)

Source: The Conference Board |

- 0.99% |

April's decline was the twelfth in 13 months for

the USD Index of Leading Economic Indicators. March's increase broke a string

of 11 consecutive monthly decreases for the Index. While still decidedly

negative, the weakness is not universal, as the number of advancing components

continues to match the number of declining ones. The outlook is for continued

weakness in the local economy through the end of 2007 and possibly into the

first part of 2008. That weakness will not likely reach the stage of a

recession, but will manifest itself in slower job growth, higher unemployment,

continued slow home sales, and a general decline in economic activity, including

sales and income growth.

Highlights:

The weak housing market continues to take a toll on construction activity, with

residential units authorized by building permits down about 13 percent in

the first quarter of 2007 compared to the same period in 2006. As was the case

for most of 2006, the slowdown is disproportionately in the permits for

single-family housing, which were off by nearly 26 percent, compared to a 3

percent decline in multi-family permits. . . The labor market variables have

turned mixed. Initial claims for unemployment insurance have fallen for

three straight months, which is a positive for the Index as it means fewer jobs

being lost. However, help wanted advertising has decreased for eight

months in a row. Most of this is due to a big drop in print advertising, as

online advertising actually increased in April. The net result was that the

local unemployment rate edged up to 4.1 percent from 3.7 percent one year ago. .

. Despite gas prices reaching record highs, local consumer confidence

continues to climb. That component has been up in each of the last eight

months. . . After dropping with the rest of the markets in March, local

stock prices followed the advance of those markets to all-time highs April

as investors anticipate the Federal Reserve lowering interest rates. . . The

national economy is weakening rapidly and the forecast is for more of the same,

as the national Index of Leading Economic Indicators has dropped in

three of the last four months. GDP growth in the first quarter came in at a

very slow 0.6 percent. That hurts the San Diego economy in two ways: First,

local firms who do business on a nationwide basis will see slower sales. And

the local tourism industry would be hurt by a slowing national economy as people

cut back their travel plans.

April's decrease puts the USD Index of Leading

Economic Indicators for San Diego County at 139.5, down from March's reading of

139.6. There were revisions in various components for November, December, and

January, some of which affected the previously reported values and changes for

the Index. Please visit the Website address given below to see the revised

changes for the individual components of the Index. The values for the USD

Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|