|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (February)

Source: University of San Diego |

- 1.1 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (February)

Source: Construction Industry Research

Board |

- 0.44% |

|

Unemployment Insurance

Initial claims for unemployment insurance

in San Diego County, inverted, estimated (February)

Source: Employment Development Department |

+ 1.37% |

|

Stock Prices

San Diego Stock Exchange Index (February)

Source: San Diego Daily Transcript |

-0.54% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (February)

Source: San Diego Union-Tribune |

- 3.87% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (February)

Source: Monster Worldwide |

- 2.66% |

|

National Economy

Index of Leading Economic Indicators (February)

Source: The Conference Board |

-0.58% |

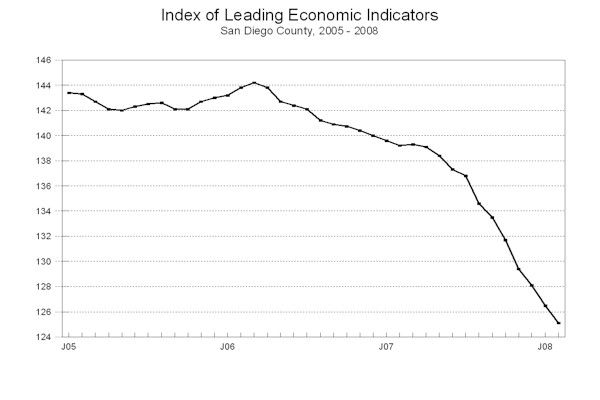

With February's

decrease, the USD Index has now fallen in 22 of the last 23 months, with the

declines in the last five months being relatively severe.

While there has not been a massive loss of jobs as was the case in the

early 1990s, job growth has come to a virtual standstill, with only 300 more

jobs countywide in February compared to the year before.

The weak housing market

remains the culprit, with more than 13,000 jobs lost in real estate-related

sectors compared to a year ago. The

continued sharp declines in the Leading Indicators indicate no turnaround in

sight at the current time.

Highlights:

After falling in 2007 to their lowest level since 1996, residential units

authorized by building permits stumbled out of the gate in 2008.

The 146 single-family units authorized in February were the lowest number

in a month since November 1992. . . The labor market variables were mixed in

both January and February.

Initial claims for unemployment insurance dropped after a big surge in

October and November, indicating at least a temporary slowing in the rate of job

loss locally. On the hiring side of

the labor, help wanted advertising continued to fall, as employers become

cautious in the face of a slowing economy.

Due to structural changes in the help wanted advertising market, this

component will now only consider Monster.com's measure of online advertising.

The net impact was that the local unemployment rate hit and topped the 5

percent level in each of the last three months. . . Local consumer confidence

fell to its lowest level since the San Diego Union-Tribune started

gathering the data in 1996. Their

index has fallen nearly 40 percent from the year-ago level . . .

The weakness in the financial markets affected local stock prices

heavily in January and to a lesser extent in February.

. . February's

decline in the national Index of Leading Economic Indicators was the

fifth in a row for that component.

More and more macroeconomic data suggests that the national economy is headed

towards a recession, if it is not already in one.

Among other things, payroll employment has fallen by 85,000 jobs in the

first two months of 2008. It remains

to be seen whether the unprecedented action by the Federal Reserve in

drastically reducing interest rate will be enough to turn the national economy

around..

February's

decrease puts the USD Index of Leading Economic Indicators for

San Diego County

at 125.1, down from January's

reading of 126.5. Revisions in building permits, initial claims for unemployment

insurance and the national Index of Leading Economic Indicators impacted the

value of the Index and the monthly changes for the months August through

December. Please visit the Website

address given below to see the revised changes for the individual components.

The values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact: