|

Home

Leading Economic Indicators

Down in May

June 28, 2007 --

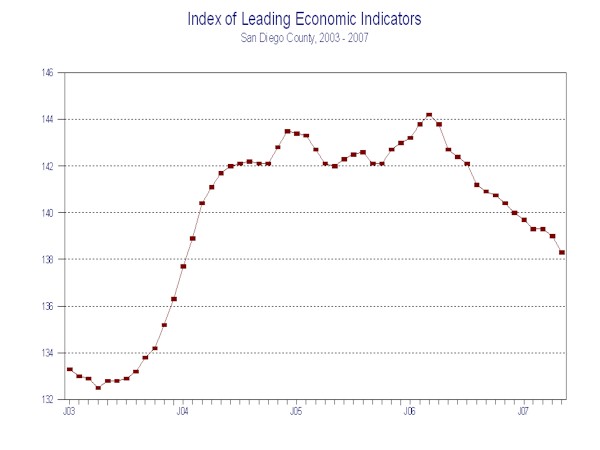

The University of San Diego's Index of Leading Economic Indicators for San Diego

County fell 0.5 percent in May. Four components -- building permits, initial

claims for unemployment insurance, consumer confidence, and help wanted

advertising -- was down during the month, each of them significantly. On the

upside, local stock prices and the outlook for the national economy were

positive, but only moderately so.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (May)

Source: University of San Diego |

- 0.5 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (May)

Source: Construction Industry Research

Board |

- 0.83% |

|

Unemployment Insurance

Initial claims for unemployment insurance

in San Diego County, inverted (May)

Source: Employment Development Department |

- 1.14% |

|

Stock Prices

San Diego Stock Exchange Index (May)

Source: San Diego Daily Transcript |

+ 0.32% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (May)

Source: San Diego Union-Tribune |

- 1.14% |

|

Help Wanted Advertising

An index of print and online help wanted advertising in

San Diego (May)

Source: Monster Worldwide, San Diego Union-Tribune |

- 0.96% |

|

National Economy

Index of Leading Economic Indicators (May)

Source: The Conference Board |

+ 0.57% |

With May's

drop, the USD Index of Leading Economic Indicators has now fallen in 13 of the

last 14 months. The four negative components in the month overwhelmed the two

positive ones to produce the largest monthly drop in the Index since August of

last year. The slump in the housing market has begun to affect other parts of

the local economy. Year-over-year job growth in May was an anemic 4,200,

compared to a gain of nearly 18,000 jobs for all of 2006. May's

result was the worst year-over-year job gain since June 2003. The slowing in

job growth in early 2007 was due almost exclusively declines in housing-related

industries such as construction, real estate, and lending. May's

data shows that the job losses are accelerating in those areas and are

spreading to other

sectors as well. These include previously strong areas such as professional and

technical services, personal services, and leisure and hospitality. While there

is still job growth in those sectors, the rate of growth has slowed

considerably. The outlook is that this will continue for the rest of 2007 and

into at least the early part of 2008.

Highlights:

The slump in construction continues, with residential units authorized by

building permits down nine times in the last 10 months. . . Both labor

market variables have become decidedly negative. Job losses have increased

significantly, as measured by a surge in initial claims for unemployment

insurance. Hiring also remains weak, with help wanted advertising

down for the ninth month in a row. The net impact was that the local

unemployment rate in May rose to 4.2 percent, compared with 3.7 percent one year

ago. . . The record high gas prices finally took a toll on local consumer

confidence, which dropped sharply after rising for eight consecutive months.

. . Despite some turbulence, local stock prices registered a modest gain

in May, advancing for the eighth time in nine months. . . The national economic

news is mixed. While there is some concern about the weakness in housing

dragging down the economy as a whole, the national Index of Leading Economic

Indicators was up for the month, and recent data show that inflation is also

a concern. The latter events reduce the pressure on the Federal Reserve to

reduce interest rates, which would have helped the housing market. I anticipate

that a decrease in interest rates will come, but not until 2008 (coincidentally,

an election year).

May's

decrease puts the USD Index of Leading Economic Indicators for San Diego County

at 138.3, down from April's

revised reading of 139.0. A revision in March initial claims for unemployment

insurance moved the previously reported gain of 0.2 percent to unchanged

instead. Revisions in building permits, initial claims for unemployment

insurance, and the outlook for the national economy for April caused the

previously reported change of -0.1 percent to be changed to -0.2 percent.

Please visit the Website address given below to see the revised changes for the

individual components of the Index. The values for the USD Index for the last

year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|