|

| April 11, 2001 -- The University of San Diego's Index of Leading Economic Indicators for San Diego County fell 0.4 percent in February. The decline was the result of sharp drops in consumer confidence, local stock prices, and a smaller decrease in the outlook for the national economy. Three components--building permits, initial claims for unemployment insurance, and help wanted advertising--were positive, with building permits registering the largest gain. |

|

|

Index of Leading Economic

Indicators The index for San Diego County that includes the components listed below (February) Source: University of San Diego |

- 0.4 % |

|

Building Permits

Residential units authorized by building permits in San Diego County (February) Source: Construction Industry Research Board |

+ 0.99% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted (February) Source: Employment Development Department |

+ 0.60% |

|

Stock Prices San Diego Stock Exchange Index (February) Source: San Diego Daily Transcript |

- 1.72% |

|

Consumer Confidence

An index of consumer confidence in San Diego County (February) Source: San Diego Union-Tribune |

- 2.30% |

|

Help Wanted Advertising

An index of help wanted advertising in the San Diego Union-Tribune (February) Source: Greater San Diego Chamber of Commerce |

+ 0.32% |

|

National Economy

Index of Leading Economic Indicators (February) Source: The Conference Board |

- 0.33% |

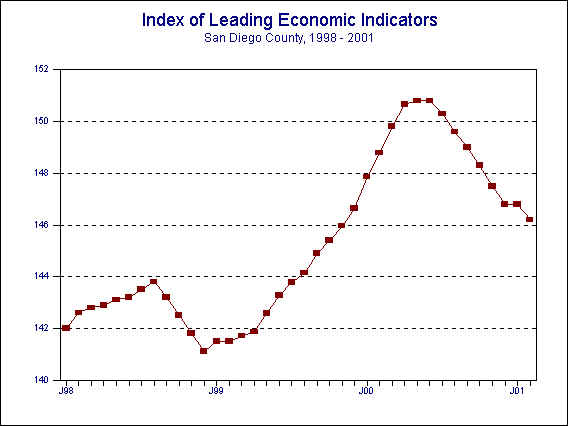

After a brief respite in January, the USD Index of Leading Economic Indicators continued the slide that began in July of last year. Counting the unchanged months, the Index has not risen in the last nine months. In terms of breadth, the Index was once again evenly divided in terms of its positive and negative components. Unfortunately, the magnitude of the drops in consumer confidence and local stock prices overwhelmed the positive components in the Index. One bright spot is that the three positive components–building permits, initial claims for unemployment insurance, and help wanted advertising--represent more tangible economic activity involving construction and the labor market, while the three negative components–local stock prices, consumer confidence, and the outlook for the national economy–represent influences that have an indirect effect on the local economy. Nevertheless, the outlook for the local economy remains unchanged from recent months: weakness in the second half of 2001, although the year as a whole will likely be positive.

Highlights: It was previously reported that the national Index of Leading Economic Indicators had its largest gain in nearly five years in January. However, that gain was revised downward in the latest release of data. Although it was still positive, the reduced magnitude of the gain caused the local Index to go from positive in January to unchanged (see below). . . After registering the highest total for the month of January since 1990, residential units authorized by building permits had the highest February figure since that year. The number of units authorized in the first two months of 2001 is up nearly 44% over the same period in 2000. . . The labor market remains strong, with initial claims for unemployment insurance continuing to drop and help wanted advertising rising. Initial claims for unemployment insurance have now decreased for six consecutive months, which is a positive for the Index, while help wanted advertising broke a string of six consecutive monthly drops. As a result, the unemployment rate remains under the 3% mark, with an unemployment rate of only 2.6% in February. . . Local stock prices have decreased for nine months in a row, an indication that the financial markets have concerns about the prospects for San Diego-based companies. Also problematic is the effect that this has on consumers, both in terms of their reduced wealth and their confidence about the future. . . Consumer confidence has fallen in 11 of the last 12 months, with only a tiny gain in December breaking the string. The raw measure of consumer confidence is now down 21% from a year ago.

February's decrease puts the Index of Leading Economic Indicators for San Diego County at 146.2, down from January’s revised reading of 146.8. A downward revision in the national Index of Leading Economic Indicators caused the previously reported change of +0.1% in January to be revised downward to unchanged. The fluctuations of the Index of Leading Economic Indicators for San Diego County for the last year are given below:

| Index | % Change | ||

| 2000 | FEB | 148.8 | +0.6% |

| MAR | 149.8 | +0.7% | |

| APR | 150.7 | +0.6% | |

| MAY | 150.8 | +0.1% | |

| JUN | 150.8 | +0.0% | |

| JUL | 150.3 | -0.3% | |

| AUG | 149.6 | -0.5% | |

| SEP | 149.0 | -0.4% | |

| OCT | 148.3 | -0.5% | |

| NOV | 147.5 | -0.6% | |

| DEC | 146.8 | -0.4% | |

| 2001 | JAN | 146.8 | +0.0% |

| FEB | 146.2 | -0.4% |

For more information on the University of San Diego's Index of Leading Economic Indicators, please contact:

| Professor Alan Gin

School of Business Administration University of San Diego 5998 Alcalá Park San Diego, CA 92110 |

TEL: (619) 260-4883 FAX: (619) 501-2954 E-mail: agin@home.com |