|

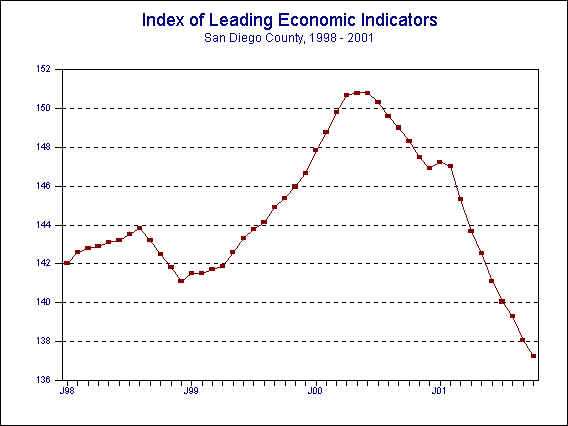

| December 12, 2001 -- The University of San Diego's Index of Leading Economic Indicators for San Diego County fell 0.6 percent in October. Three components–building permits, initial claims for unemployment insurance, and help wanted advertising–were down during the month, the latter two sharply. Local stock prices, consumer confidence, and the outlook for the national economy were positive, but the gains in those components were relatively small and outweighed by the negative components. |

|

|

Index of Leading Economic

Indicators The index for San Diego County that includes the components listed below (October) Source: University of San Diego |

- 0.6 % |

|

Building Permits

Residential units authorized by building permits in San Diego County (October) Source: Construction Industry Research Board |

- 0.34% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted (October) Source: Employment Development Department |

- 2.79% |

|

Stock Prices San Diego Stock Exchange Index (October) Source: San Diego Daily Transcript |

+ 0.36% |

|

Consumer Confidence

An index of consumer confidence in San Diego County (October) Source: San Diego Union-Tribune |

+ 0.43% |

|

Help Wanted Advertising

An index of help wanted advertising in the San Diego Union-Tribune (October) Source: Greater San Diego Chamber of Commerce |

- 1.91% |

|

National Economy

Index of Leading Economic Indicators (October) Source: The Conference Board |

+ 0.49% |

October’s decrease was the ninth consecutive monthly decrease in the USD Index of Leading Economic Indicators. One bright spot was that there was an even split between positive components and negative ones. This was the first time that the breadth was not negative since February, and may portend that any weakness in San Diego’s economy in the months ahead will be relatively mild. The outlook remains for some rough spots in the local economy through the first half of 2002 and a resumption of moderate growth starting sometime next summer.

Highlights: Residential units authorized by building permits remain down slightly through October compared to the same period in 2000. Although the number of single-family units authorized are up, it is not enough to offset a larger decrease in the number of multi-family units authorized. . . Initial claims for unemployment insurance totaled 17,559 in October, the highest monthly total since July 1997. This mirrored the situation in the national economy, where there was a decrease of nearly 470,000 jobs during that month. Local industries showing the biggest percentage decreases in employment in October include amusement services (down 4.9%) and air transportation (down 3.2%). . . Due to a data reporting error, it was reported last month that help wanted advertising increased in September. That component actually decreased when the correct data were used. Combined with a decrease in October, help wanted advertising has now declined for eight months in a row. . . After plunging in September in the wake of the terrorist attacks, local stock prices rebounded slightly in October. . . The trend in consumer confidence remained positive for the third month in a row, although the magnitude of the gain was much smaller than in the previous two months. . . The national Index of Leading Economic Indicators avoided a third straight decrease with October’s gain. However, the National Bureau of Economic Research has declared that the national economy has been in a recession since March of this year. Furthermore, the rate of growth in gross domestic product in the third quarter was revised downward to -1.1% from the previously reported -0.4%.

October's decrease puts the Index of Leading Economic Indicators for San Diego County at 137.2. The correction of the error in the help wanted advertising data caused the change for September to be revised downward from -0.5% to -0.9%. On top of that, it was discovered that an incorrect formula was used to calculate the change in stock prices since the beginning of the year. When that was corrected, there was no change in the direction of the changes (except that January was positive instead of unchanged), although the magnitudes of the changes were affected slightly. The corrected values for the Index of Leading Economic Indicators for San Diego County for the last year are given below:

| Index | % Change | ||

| 2000 | OCT | 148.3 | -0.5% |

| NOV | 147.5 | -0.6% | |

| DEC | 146.9 | -0.4% | |

| 2001 | JAN | 147.2 | +0.2% |

| FEB | 147.0 | -0.2% | |

| MAR | 145.3 | -1.1% | |

| APR | 143.7 | -1.2% | |

| MAY | 142.5 | -0.8% | |

| JUN | 141.1 | -1.0% | |

| JUL | 140.0 | -0.7% | |

| AUG | 139.3 | -0.5% | |

| SEP | 138.1 | -0.9% | |

| OCT | 137.2 | -0.6% |

For more information on the University of San Diego's Index of Leading Economic Indicators, please contact:

| Professor Alan Gin

School of Business Administration University of San Diego 5998 Alcalá Park San Diego, CA 92110 |

TEL: (619) 260-4883 FAX: (619) 501-2954 E-mail: agin@home.com |