|

Home

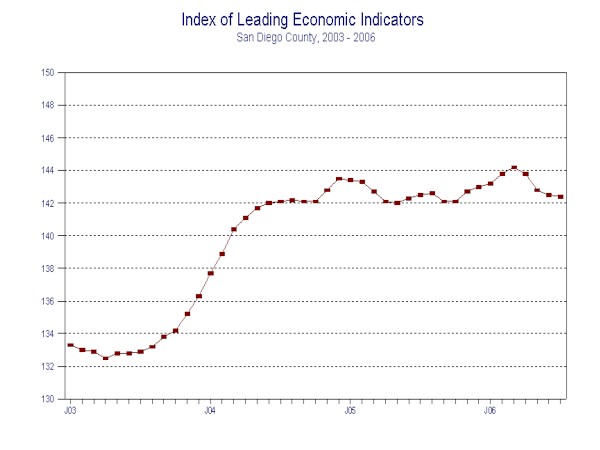

Leading Economic Indicators

Down Slightly in July

September

6, 2006 --The University of San Diego's Index of Leading Economic Indicators for

San Diego County fell 0.1 percent in July. Five

components were down during the month, with a large increase in initial claims

for unemployment insurance (a negative for the Index) leading the way.

The four other declining components (local stock prices, consumer

confidence, help wanted advertising, and the outlook for the national economy)

were down only slightly. These were

nearly offset by a sharp increase in building permits, the only positive

component in the Index.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (July)

Source: University of San Diego |

- 0.1 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (July)

Source: Construction Industry Research

Board |

+ 1.75% |

|

Unemployment Insurance

Initial claims for unemployment insurance

in San Diego County, inverted (July)

Source: Employment Development Department |

- 1.53% |

|

Stock Prices

San Diego Stock Exchange Index (July)

Source: San Diego Daily Transcript |

- 0.37% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (July)

Source: San Diego Union-Tribune |

- 0.14% |

|

Help Wanted Advertising

An index of print and online help wanted advertising in

San Diego (July)

Source: Monster Worldwide, San Diego Union-Tribune |

- 0.19% |

|

National Economy

Index of Leading Economic Indicators (July)

Source: The Conference Board |

- 0.14% |

July's

move was the fourth consecutive monthly decrease in the USD Index of Leading

Economic Indicators. The decline was

broad based, with five of the six components down during the month.

Interestingly, almost all of the components turned negative in April and

many have remained negative since. Given

the negative indications, the outlook is for a slowing in the local economy

towards the end of 2006, with the weakness extending at least through the

beginning of 2007. This weakness

will be manifested in the form of slower job growth (about 15,000 compared to the

current 18,000 - 19,000) and the unemployment rate edging up to 4.5 percent.

Highlights:

Residential units authorized by building permits posted a second straight

strong gain after declining for a full year.

Strength in multifamily units authorized is largely responsible for the

turnaround. . . The labor market variables were both down in July, indicating

weakness in terms of both job losses and hiring plans.

While still relatively low compared to historic levels,

initial claims for unemployment insurance are up more than 20%

from the low reached in November of 2005. Help

wanted advertising remains weak, with an increase in online advertising only

partially offsetting declines in print advertising.

The consequence is that the local unemployment rate has increased to 4.3

percent in July after being under 4 percent for much of the spring. . . After

finishing 2005 and beginning 2006 with a rebound, consumer confidence has

slipped again. The war in Iraq, high

gas prices, an uncertain housing market, and political turmoil locally,

nationally, and internationally are some of the reasons for consumer pessimism.

Consumer spending could by adversely affected, which is significant

because consumer spending is typically two-thirds of economic activity. . .

With the Nasdaq Composite Index in the red for the year, local stock prices

remain under pressure. They have

mirrored the overall Index and have fallen for four months in a row. . . The national

Index of Leading Economic Indicators indicates potential problems for the

national economy. Although down only

slightly in July, the national Index has decreased in three of the last four

months and four of the last six. A

weak national economy would hurt San Diego's

tourism industry and those firms who sell products nationally.

The

Index of Leading Economic Indicators for San Diego County stood at 142.4 in

July, down slightly from June's

reading. Please visit the Index of

Leading Economic Indicators Website at the address below to get the values for

any revised components. The values

for the Index of Leading Economic Indicators for San Diego County for the last

year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|