|

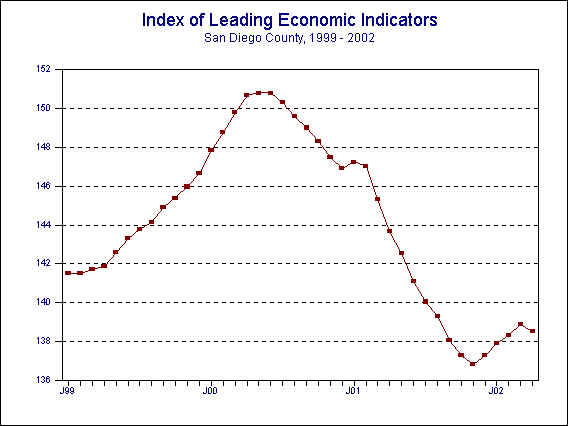

| May 23, 2002 --The University of San Diego's Index of Leading Economic Indicators for San Diego County fell 0.3 percent in April. An extremely negative reading for initial claims for unemployment insurance led the downward move. There were also smaller drops in building permits and the outlook for the national economy. These negatives outweighed a sharp rise in consumer confidence and smaller gains in local stock prices and help wanted advertising. |

|

|

Index of Leading Economic

Indicators The index for San Diego County that includes the components listed below (April) Source: University of San Diego |

- 0.3 % |

|

Building Permits

Residential units authorized by building permits in San Diego County (April) Source: Construction Industry Research Board |

- 0.23% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted (April) Source: Employment Development Department |

- 4.08% |

|

Stock Prices San Diego Stock Exchange Index (April) Source: San Diego Daily Transcript |

+ 0.47% |

|

Consumer Confidence

An index of consumer confidence in San Diego County (April) Source: San Diego Union-Tribune |

+ 2.46% |

|

Help Wanted Advertising

An index of help wanted advertising in the San Diego Union-Tribune (April) Source: Greater San Diego Chamber of Commerce |

+ 0.39% |

|

National Economy

Index of Leading Economic Indicators (April) Source: The Conference Board |

- 0.65% |

April’s decrease broke a streak of four consecutive monthly increases for the USD Index of Leading Economic Indicators. The components were evenly divided between positive and negative ones, with differences in the magnitudes of the changes leading to the decline. The one-month drop is not necessarily an indication of a return to the earlier downward trend in the Index. But it is a sign that some rough spots remain to be dealt with in the local economy, particularly in terms of the labor market. The outlook remains for erratic behavior in the local economy through the first half of 2002, with stronger signs of growth in the second half of the year.

Highlights: Residential units authorized by building permits were down slightly on a month-to-month basis, but are now up roughly 1% for the year as a whole. . . There was a big contrast in the performance of the labor market components. Initial claims for unemployment insurance surged in April, which is a negative for the Index. A total of 21,843 claims were filed in the month, which topped the recent high in January and which is the highest number of claims filed since January 1997. This is particularly disconcerting since April is usually the second lowest month of the year for initial claims filed. On the other hand, help wanted advertising extended its modest streak of gains to two months. The job losses indicated by the increase in initial claims has not been reflected in the local labor market statistics, as the unemployment rate for San Diego County dropped slightly to 3.8% in April. That rate is expected to edge up over the 4% mark in the next couple of months. . . Local stock prices rose slightly in April, bucking the trend in the rest of the markets. The Nasdaq Composite Index fell roughly 8.5% during the month, while the Standard and Poor’s 500 Index decreased by more than 6%. . . Local consumer confidence registered its biggest one month percentage gain ever in April. This is significant since consumer spending typically represents two-thirds of economic activity. . . The national Index of Leading Economic Indicators fell in April, breaking a string of six months in a row with positive or unchanged readings. This raised concerns by economists and financial analysts about the strength of the recovery in the national market. This reflects my view that the performance of the national economy will look like the letter "W," with some more negative numbers ahead until a full rebound later in the year.

April's decrease puts the Index of Leading Economic Indicators for San Diego County at 138.5, down from March’s reading of 138.9. The values for the Index of Leading Economic Indicators for San Diego County for the last year are given below:

| Index | % Change | ||

| 2001 | APR | 143.7 | -1.2% |

| MAY | 142.5 | -0.8% | |

| JUN | 141.1 | -1.0% | |

| JUL | 140.0 | -0.7% | |

| AUG | 139.3 | -0.5% | |

| SEP | 138.1 | -0.9% | |

| OCT | 137.3 | -0.5% | |

| NOV | 136.8 | -0.4% | |

| DEC | 137.3 | +0.4% | |

| 2002 | JAN | 137.9 | +0.4% |

| FEB | 138.3 | +0.3% | |

| MAR | 138.9 | +0.5% | |

| APR | 138.5 | -0.3% |

For more information on the University of San Diego's Index of Leading Economic Indicators, please contact:

| Professor Alan Gin

School of Business Administration University of San Diego 5998 Alcalá Park San Diego, CA 92110 |

TEL: (619) 260-4883 FAX: (619) 501-2954 E-mail: agin@cox.net |