|

Index of Leading Economic

Indicators

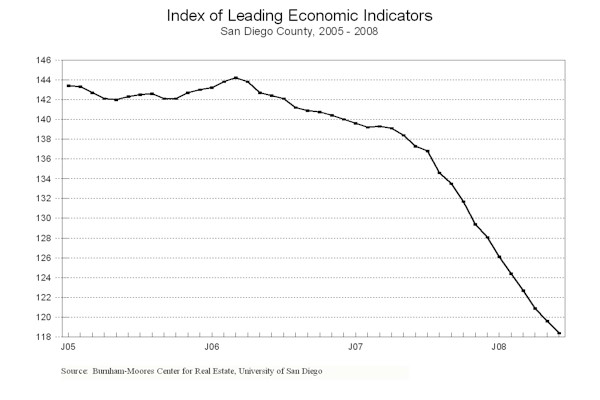

The index for San Diego County that

includes the components listed below (June)

Source: University of San Diego |

- 1.0 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (June)

Source: Construction Industry Research

Board |

+ 1.94% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted (June)

Source: Employment Development Department |

- 0.67% |

|

Stock Prices

San Diego Stock Exchange Index (June)

Source: San Diego Daily Transcript |

- 1.34% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (June)

Source: San Diego Union-Tribune |

- 4.89% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (June)

Source: Monster Worldwide |

- 0.78% |

|

National Economy

Index of Leading Economic Indicators (June)

Source: The Conference Board |

- 0.19% |

The outlook for the local economy remains unchanged from recent months:

Continued weakness in the local economy through the first half of 2009, with no

end in sight at this point. As was

projected in last month's

report, job growth for the first half of 2008 has now turned negative.

This marks the first time since September 1993 that job growth has been

negative over a six month (two quarter) period when compared to the previous

year. The weakness in the labor market

dates back even farther, with the run-up in the unemployment rate beginning one

year ago in June 2007.

Highlights:

Despite rebounding strongly in

June, residential units authorized by building permits were down more

than 30 percent for the first half of 2008 compared to the same period in 2007.

A surge in multi-family units authorized in June cut the loss in that

category to 21 percent for the first half, while single-family units are down by

almost 39 percent. . . Both labor market variables continue to be weak.

For the first six months of 2008, a total of 95,723 initial claims for

unemployment insurance were filed, compared to 76,289 for the same period in

2007. On the hiring side of the

market, help wanted advertising fell for the 22nd straight

month. As a result, the local

unemployment rate jumped to 5.9 percent in June from the 5.5 percent rate in

May. . . The turnaround in the raw data for local consumer confidence in

May turned out to be a aberration, with the local measure resuming its decline

in June. In total, local consumer

confidence dropped 37 percent in the first half of 2008. . . Local stock

prices were battered along with other stocks as the equity markets suffered

their worst June in decades, with the Dow Jones Industrial Average down more

than 10 percent in the month and the Nasdaq Composite down more than 9

percent. . . The national Index of Leading Economic Indicators dipped for

the second month in a row as the news on the national economy remains mixed.

Growth in Gross Domestic Product for the first quarter of 2008 was

revised upward to 1.0 percent from the previous revised value of 0.9 percent

(the original estimate was 0.6 percent).

However, the national economy has lost jobs in each of the first six

months of 2008, and the national unemployment rate remained at an elevated 5.5

percent..

June's

decrease puts the USD Index of Leading Economic Indicators for San Diego County

at 118.4, down from May's revised reading of 119.6. Revisions in building

permits and the national Index of Leading Economic Indicators caused the

previously reported change of -1.1 percent to be revised to -1.2 percent for the

month. Please visit the Website

address given below to see the revised changes for the individual components.

The values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact: