|

Home

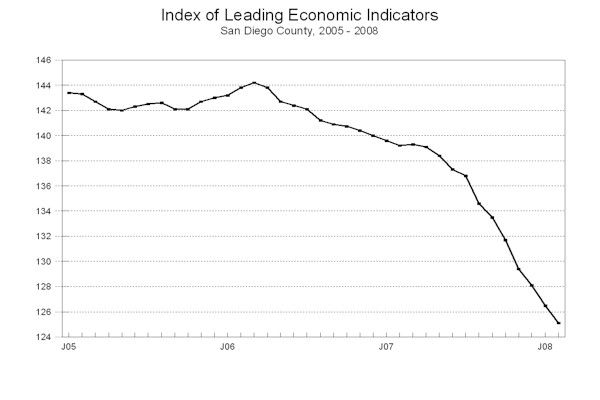

Leading Economic Indicators

Down Sharply in March

April 30, 2008 --

The University of San Diego's

Index of Leading Economic Indicators for San Diego County fell 1.4 percent in

March. The six components were

split evenly, but sharp drops in three of the components - - building permits,

consumer confidence, and help wanted advertising - - overwhelmed the much

smaller gains in initial claims for unemployment insurance, local stock prices,

and the outlook for the national economy.

March's

drop was the six consecutive significant decline in the Index, which has now

fallen in 23 of the last 24 months.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (March)

Source: University of San Diego |

- 1.4 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (March)

Source: Construction Industry Research

Board |

- 1.96% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted (March)

Source: Employment Development Department |

+ 0.76% |

|

Stock Prices

San Diego Stock Exchange Index (March)

Source: San Diego Daily Transcript |

+0.10% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (March)

Source: San Diego Union-Tribune |

- 4.63% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (March)

Source: Monster Worldwide |

- 2.57% |

|

National Economy

Index of Leading Economic Indicators (March)

Source: The Conference Board |

+0.19% |

The outlook for the local economy is for continued weakness

for the rest of 2008, with job growth flat or even negative.

Data for March shows employment down 1,700 jobs compared to the same

month in 2007, the first negative year-to-year job comparison since July 1993.

The weak housing market was the chief cause of the decline, with more

than 14,000 jobs lost in real estate-related sectors (construction, real estate,

and lending). Whether this is the

start of a negative trend or just a one month aberration remains to be seen.

Highlights:

Construction plans, as measured by residential units authorized by building

permits, have virtually dried up in response to the weak housing market.

The 193 residential units authorized in March was the lowest monthly

total for building permits since November 1992.

Only eight multi-family units were authorized in March, which compares to

804 units authorized in the same month last year and which is the lowest number

authorized in a month since only four units were authorized in February 1995.

For the first quarter of 2008, total residential units authorized are

down more that 63 percent compared to the first quarter of 2007.

Single-family units authorized were down 48 percent while multi-family

units authorized were down nearly 74 percent.

What is particularly troubling is that 2007 was already the slowest year

for building permits since 1996. . . The labor market variables remain mixed.

After a post-holiday surge in January, initial claims for unemployment

insurance have edge downward, which indicates that mass layoffs are not

occurring locally. While job losses

are not widespread, the hiring side of the market remains weak, with help

wanted advertising now down 19 straight months.

The net result was the local unemployment rate rising to a five-year high

of 5.3 percent in March. . . Local consumer confidence suffered its

largest one month decline ever as gas prices hit record highs.

Combined with bad news on the housing and jobs market, local consumer

confidence is at an all-time low, down more than 40 percent from a year ago . .

. Local stock prices ended a four month losing streak by edging up

slightly in March. . . The national Index of Leading Economic Indicators

turned upward for the first time in six months.

But GDP numbers for the first quarter are likely to be negative, as the

national economy has lost jobs in each of the first three months of 2008.

March's

decrease puts the USD Index of Leading Economic Indicators for San Diego County

at 122.7, down from February's revised reading of 124.4. Revisions in initial

claims for unemployment insurance affected the value of the Index for both

January and February, as well as the previously reported changes for those

months. Please visit the Website

address given below to see the revised changes for the individual components.

The values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|