|

Home

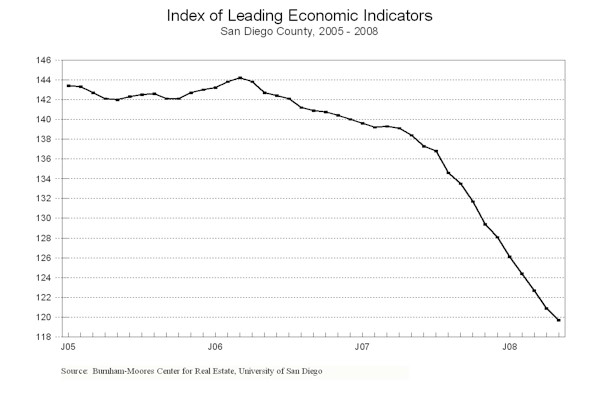

Leading Economic Indicators

Down Sharply in May

Note: The tentative date for the

release of next month's

report is July 29.

June 26, 2008 --

The University of San Diego's Index of Leading Economic Indicators for San Diego

County fell 1.1 percent in May. For the

sixth consecutive month, the leader on the downside was a sharp drop in consumer

confidence. Initial claims for

unemployment insurance and help wanted advertising were also down considerably.

Three components - - building permits, local stock prices, and the

outlook for the national economy - - were

positive, but only slightly so. With May's

decline, the USD Index has now fallen in 25 of the last 26 months, and it has

declined significantly for eight straight months.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (May)

Source: University of San Diego |

- 1.1 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (May)

Source: Construction Industry Research

Board |

+ 0.06% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted (May)

Source: Employment Development Department |

- 0.82% |

|

Stock Prices

San Diego Stock Exchange Index (May)

Source: San Diego Daily Transcript |

+0.14% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (May)

Source: San Diego Union-Tribune |

- 4.79% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (May)

Source: Monster Worldwide |

- 1.22% |

|

National Economy

Index of Leading Economic Indicators (May)

Source: The Conference Board |

+0.19% |

There is no sign of any change in the negative outlook for the local economy for

the near future, with the slump now likely to extend through the first half of

2009. The labor market is looking

particularly weak at this point. For the

second time in three months, job growth in May was down on a year-over-year

basis. Employment growth for 2008 as a

whole through May is now just barely positive with a gain of only 400 jobs

compared to the same period in 2007.

Barring a huge surge in jobs in June, employment growth for 2008 as a whole will

probably turn negative when the

next employment report is

released. How long the job losses

continue and how deep they will be is uncertain at this point.

Highlights:

Residential units authorized by building permits turned positive in May

after being down in each of the first four months of the year.

Although they are still down considerably for the year and are at levels

not seen since the 1960s, building permits have rebounded a little from the

16-year low reached in March. . . Both sides of the labor market continue to be

under pressure. Job losses remain at

an elevated level, as indicated by a rise in initial claims for unemployment

insurance. At the same time,

hiring plans continue to be slow, with help wanted advertising now being

down for 21 consecutive months. The

net result was that the local unemployment rate jumped to 5.5 percent in May,

its highest level since July 2003. . . Although the raw data on local

consumer confidence showed an increase from April to May, the trend

continues to be sharply negative. A

moving average of the seasonally adjusted data is used to determine the overall

trend by filtering out random monthly fluctuations. . . Local stock prices

advanced for the third consecutive month, although those gains will be erased

due to the heavy losses in the financial markets in June. . . Data for the

national economy remains mixed.

Although employment at the national level has fallen in each of the first five

months of 2008, the growth rate of GDP was revised upward to 0.9 percent for the

first quarter. The national Index

of Leading Economic Indicators has now risen or been unchanged for the last

three months.

May's

decrease puts the USD Index of Leading Economic Indicators for San Diego County

at 119.7, down from April's revised reading of 120.9.

In a statistical oddity, a revision of the national Index of Leading

Economic Indicator for March had no impact on that month or the previously

reported change for April, but did impact the overall level of the local Index

for April. Please visit the Website

address given below to see the revised changes for the individual components.

The values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|