|

Home

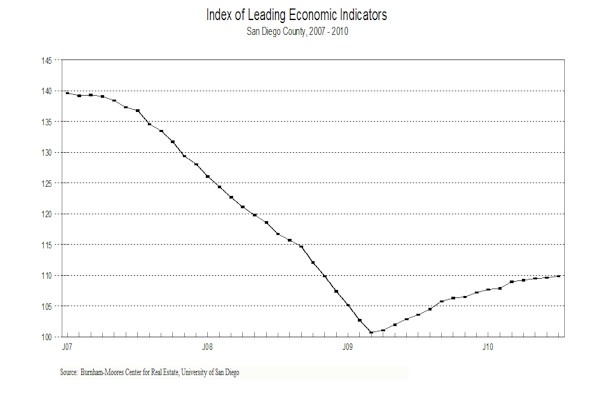

Leading Economic Indicators

Up in July

Note:

The tentative release date for next month's report is September 28.

August 31, 2010 -- The

University of San Diego's Index of Leading Economic Indicators for San Diego

County rose 0.3 percent in July. Leading the move to the upside were strong

gains in local consumer confidence and help wanted advertising. Building permits

and the outlook for the national economy were also positive, but to a lesser

extent. On the downside, initial claims for unemployment insurance rose sharply,

which is a negative, and local stock prices were down slightly. With July’s

gain, the USD Index has now increased for 16 months in a row.

|

Index of Leading Economic

Indicators

The index for San Diego County that includes the

components listed below (July)

Source: University of San Diego |

+ 0.3 % |

|

Building Permits

Residential units

authorized by building permits in San Diego County (July)

Source: Construction Industry Research

Board |

+ 0.29% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted

(July)

Source: Employment Development Department |

- 0.92% |

|

Stock Prices

San Diego Stock Exchange Index (July)

Source:

San Diego Daily Transcript |

- 0.35% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (July)

Source:

San Diego Union-Tribune |

+ 1.28% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (July)

Source: Monster Worldwide |

+ 1.08% |

|

National Economy

Index of Leading Economic Indicators (July)

Source: The Conference Board |

+ 0.18% |

There have been concerns

about a possible "double dip" recession at the national level and similar

worries about the local economy. The USD Index remaining positive suggests that

a downturn in the local economy is not on the horizon, but as has been indicated

in previous reports, growth is likely to be very weak. What is keeping the

economy stagnant both locally and nationally is a high unemployment/low consumer

spending cycle. With the local unemployment rate above 10 percent for 14

straight months and incomes for many households flat or declining, consumer

confidence in the economy has fallen. With confidence down, consumers are

spending less and businesses are selling less, which means that hiring is slow

and the cycle is perpetuated. Through streamlining their operations to achieve

greater efficiency, companies have been able to earn solid profits even during

this downturn. Due to the streamlining, some of the jobs lost will never come

back, and the lack of consumer spending is causing some businesses to be content

with sitting on huge amounts of cash as opposed to hiring more workers. The

cycle seems to have stabilized in that the economy is not cycling downward, but

there is no upward momentum either.

Highlights: The trend

for residential units authorized by building permits was positive for the

eighth month in a row, although the gain was not very large. Developers are

reacting positively but cautiously to a housing market that has seen prices

increase by nearly 13 percent according to the Case-Shiller Home Price Index

since the bottom in April 2009. . . For the fourth straight month, initial

claims for unemployment insurance were negative while there was an increase

in help wanted advertising. The implication is that while businesses have

increased their hiring, job loss remains a big problem for the local economy.

The net result was that the local unemployment rate rose to 10.8 percent in July

from a rate of 10.5 percent in June. . . Local consumer confidence rose

for the third consecutive month as the raw value for that component reached its

highest level since September of last year. . . Local stock prices fell

with the rest of the financial markets as investors reacted to continued

negative economic data. . . While the national Index of Leading Economic

Indicators rebounded to a gain in July after falling the previous month, the

national economy continues to slow. The "second" estimate of Gross Domestic

Product (GDP) growth came in at a very weak 1.6 percent for the second quarter

of this year. This was after a gain of 5.0 percent in the fourth quarter of 2009

and 3.7 percent in the first quarter of 2010.

July’s increase puts the USD Index of Leading Economic Indicators for San

Diego County at 109.9, up from June’s revised reading of 109.6, down from the

originally reported level of 109.7. Revisions were made in the national Index of

Leading Economic Indicators for March, April, and June, but the only change was

in the level of the Index for June. Please visit the Website address given below

to see the revised changes for the individual components. The values for the USD

Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|