|

Home

Leading Economic Indicators

Up in December

Note:

A problem with the data delayed the release of this report.

The tentative release date for next month's report is February 25.

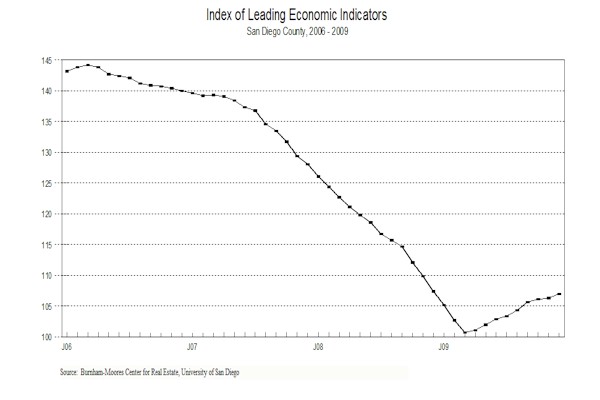

February 11, 2010 -- The University of

San Diego's Index of Leading Economic Indicators for San Diego County rose 0.7

percent in December. For the first time since April 2004, all six of the

components in the USD Index were up in the month. The advance was led by a sharp

increase in the outlook for the national economy. Four components - - building

permits, initial claims for unemployment insurance, local stock prices, and help

wanted advertising - - were up moderately, while local local consumer confidence was

up but virtually unchanged. With a revision to last month’s unchanged

reading, the USD Index has now risen for nine consecutive months.

|

Index of Leading Economic

Indicators

The index for San Diego County that includes the

components listed below (December)

Source: University of San Diego |

+ 0.7 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (December)

Source: Construction Industry Research

Board |

+ 0.65% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (December)

Source: Employment Development Department |

+ 0.22% |

|

Stock Prices

San Diego Stock Exchange Index (December)

Source:

San Diego Daily Transcript |

+ 0.39% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (December)

Source:

San Diego Union-Tribune |

+ 0.02% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (December)

Source: Monster Worldwide |

+ 0.38% |

|

National Economy

Index of Leading Economic Indicators (December)

Source: The Conference Board |

+ 2.25% |

With December’s advance in the USD Index, the

outlook continues to be positive for the local economy. There are signs of

recovery in some sectors of the economy, such as housing, where prices are up

more the eight percent from the low and where there has been a pickup in sales.

Continued strength is expected in the housing market due to low interest rates,

federal incentives for first-time and even move-up buyers, and the rebounding

economy. On the downside, there is likely to be another wave of foreclosures as

adjustable rate mortgages readjust and job losses take their toll. Still, a gain

in the single digit percentage range is expected for 2010.

Highlights: Although the year closed with

a positive month, 2009 was the worst year on record for residential units

authorized by building permits. There were fewer than 3,000 units authorized

for the entire year, which was down 42 percent from the previous low set in

2008. While single-family units authorized were down 24 percent, the biggest

damage was in multi-family units authorized, which were down 57 percent. . .

There continue to be signs of improvement in the labor market. Initial claims

for unemployment insurance fell, which is a positive for the Index and an

indication that the pace of job loss is slowing. There is also good news on the

hiring front as help wanted advertising registered a second consecutive

monthly gain after having fallen for 38 months in a row. The net result was that

the local unemployment rate was 10.1 percent in December, which was down from

the 10.6 percent rate in November but still the seventh month in a row in which

the local unemployment rate was above 10 percent. Employment fell by more than

43,000 compared to the same month in 2008. . . After leading the USD Index to

the upside since March, the trend in local consumer confidence is

beginning to flatten out. The component ended the year up nearly 49 percent and

up 71 percent from the February low. . . Local stock prices ended a three

month losing streak to end the year on a positive note. Local stocks rose nearly

28 percent in 2009. . . The national Index of Leading Economic Indicators

matched the local index by advancing for the ninth month in a row. Gross

Domestic Product grew at a 5.7 percent rate for the fourth quarter, which was

the highest growth rate in six years (since the third quarter of 2003).

December’s increase puts the USD Index of Leading Economic Indicators for San

Diego County at 107.0, up from November’s reading of 106.3. A change in the

calculation of initial claims for unemployment insurance affected the change and

the level of the Index going back to July 2008, but in no month was the

direction of the change affected. Please visit the Website address given below

to see the revised changes for the individual components. The values for the USD

Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|