|

Home

Leading Economic Indicators

Down Sharply in March

Note:

The

tentative release date for next month's report is May 28.

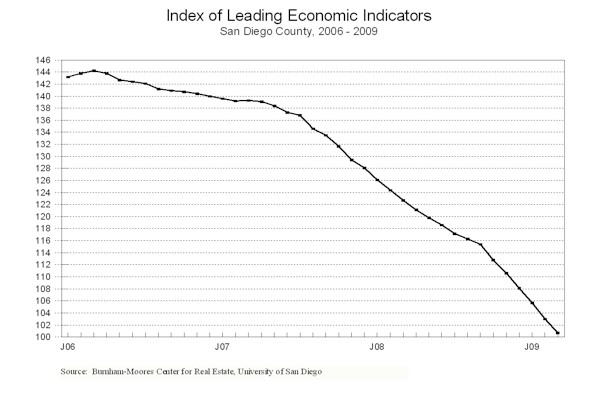

April 30, 2009 --

The University of San Diego's

Index of Leading Economic Indicators for San Diego County fell 2.2 percent in

March. All six components in the Index

were down during the month, led by another record drop in help wanted

advertising. Consumer confidence

and initial claims for unemployment insurance were also sharply negative, while

there were more moderate drops in building permits, local stock prices, and the

outlook for the national economy.

March’s decline was the 35th decrease in the USD Index in 36 months.

It was also the sixth month in a row that the Index declined by more than

two percent, which corresponds to the six largest drops on record.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (March)

Source: University of San Diego |

- 2.2 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (March)

Source: Construction Industry Research

Board |

- 1.04% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (March)

Source: Employment Development Department |

- 2.31% |

|

Stock Prices

San Diego Stock Exchange Index (March)

Source: San Diego Daily Transcript |

- 1.28% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (March)

Source: San Diego Union-Tribune |

- 3.27% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (March)

Source: Monster Worldwide |

- 4.65% |

|

National Economy

Index of Leading Economic Indicators (March)

Source: The Conference Board |

-0.61% |

The outlook for the local

economy remains strongly negative at this point with no turnaround in sight. The

bad job growth numbers for February got worse in March, with San Diego County

losing more than 44,000 jobs compared to the year before. Both the

national and local economies are caught in a vicious cycle where job losses are

reducing incomes, which reduces consumption, auto sales, and home sales, which

in turn leads to even more job losses. An added complication is the impact

on the already stressed financial system as more loans go bad in this scenario.

Highlights:

Residential units authorized by building permits rebounded after the two

worst months ever, but it was not enough to reverse the downward trend in that

component. Residential units authorized ended the first quarter down

almost 25 percent compared to the same period in 2008. While multi-family

units authorized were virtually unchanged (down 3 percent) for the period,

single-family permits were down over 43 percent compared to 2008. . . Both sides

of the labor market remain under heavy pressure as job losses mount and hiring

dries up. Initial claims for unemployment insurance topped 30,000

for the third consecutive month, while help wanted advertising fell for

the 31st month in a row. The net result was that the local

unemployment rate shot up to 9.3 percent in March from 8.9 percent in February.

. . The raw data on local consumer confidence was actually up in March

compared to February. But the USD Index uses a moving average of the data

to establish a trend by smoothing out random month-to-month fluctuations,

resulting in a negative trend for consumer confidence that has stretched for 23

straight months. . . Local stock prices turned downward as the broader

market averages hit a yearly low in early March. The subsequent rally off

those lows later in the month was not enough to break a modest two month up move

in local stocks. Despite that, local stocks prices ended the first quarter

up 3.6 percent, compared to a 13.3 percent drop in the Dow Jones Industrial

Average and a 3.1 percent decrease in the NASDAQ Composite Index. . . After

various revisions, the national Index of Leading Economic Indicators has

now fallen for three months in a row, and has now been down or unchanged for 11

consecutive months. The national economy continues to contract, with the

advance estimate for first quarter Gross Domestic Product down a worse than

expected 6.1 percent on an annualized basis. This follows a 6.3 percent

annualized drop in the fourth quarter of 2008.

March’s decrease

puts the USD Index of Leading Economic Indicators for San Diego County at 100.7,

down from February’s reading of 103.0. Revised data for building permits

and the national Index of Leading Economic Indicators led to a revision in the

value of the USD Index for January and the previously reported changes for

January and February. Please visit the Website address given below to see

the revised changes for the individual components. The values for the USD

Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|