|

Home

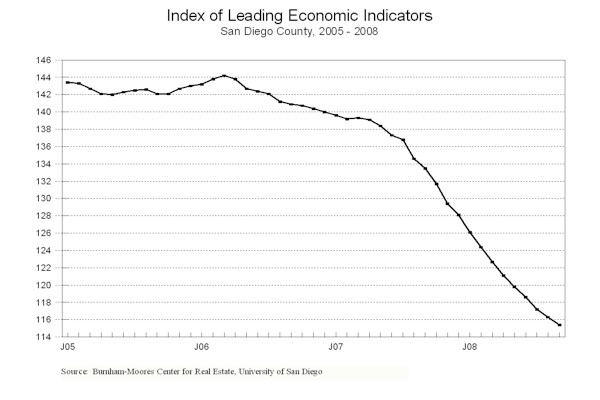

Leading Economic Indicators

Down in September

Note: The tentative date for the

release of next month's

report is November 24.

October 30, 2008 --

The University of San Diego's Index of Leading Economic Indicators for

San Diego

County fell 0.8 percent in

September. Leading the way to the

downside was a surge in initial claims for unemployment insurance, which is a

negative for the Index. Also down

considerably were building permits, local stock prices, and consumer confidence,

while there was a more modest loss in help wanted advertising.

The only positive component was the outlook for the national economy,

which was up moderately. September’s

drop marked the 29th time in 30 months that the USD Index has

dropped.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (September)

Source: University of San Diego |

- 0.8 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (September)

Source: Construction Industry Research

Board |

- 0.83% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (September)

Source: Employment Development Department |

- 1.63% |

|

Stock Prices

San Diego Stock Exchange Index (September)

Source: San Diego Daily Transcript |

- 1.19% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (September)

Source: San Diego Union-Tribune |

- 0.94% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (September)

Source: Monster Worldwide |

- 0.54% |

|

National Economy

Index of Leading Economic Indicators (September)

Source: The Conference Board |

+ 0.59% |

There is no change in the previously reported negative outlook for the local

economy through the first half of 2009.

What is needed to turn the economy around both locally and nationally is

stability in the housing market.

Falling prices and a jump in foreclosures have hurt both the labor market and

the

financial markets and institutions.

The recent increase in home resales is a positive sign, but a bottom in the

housing market in not likely to be reached until the latter part of 2009, and

home prices are not expected to increase until 2010 at the earliest.

Highlights:

A weak September broke a four month positive streak for

residential units authorized by building permits.

Total residential units authorized were down 24 percent through the

first three quarters of 2008 compared to the same period in 2007.

The large inventory of single family homes on the market led to a drop of

nearly 34 percent in single-family units authorized, compared to a 14 percent

drop in multi-family units. . . Both the labor market variables remain negative.

The pace of job loss is accelerating, as

initial claims for unemployment insurance

reached a five year high. On the

hiring side, help wanted advertising

fell for the 25th month in a row.

The net result was that the local unemployment rate remained above the 6

percent level for the third consecutive month at 6.4 percent. . . For the first

time in 11 months, local consumer

confidence was not the biggest negative component.

Local consumer confidence is still negative, but may be approaching a

bottom. It remains to be seen how

this will be impacted by the negative news in the financial markets. . .

Local stock prices fell in September

in a prelude to the disastrous results to come in October. . . The news on the

national economy remains negative despite the rise in the

national Index of Leading Economic

Indicators. September saw a loss

of 159,000 jobs nationwide, the worst result since March 2003.

Also, the previously reported growth rate of Gross Domestic Product (GDP)

for the second quarter was revised downward from 3.3 percent to 2.8 percent.

There is a strong possibility that growth in the third quarter will be

negative, given the job losses and the turmoil in the financial markets, with a

weak fourth quarter to follow. It is

very likely that a recession will be declared for the national economy; in fact,

we may be there already.

September’s decrease puts the USD Index of Leading Economic Indicators for

San Diego

County at 115.4, down from

August’s revised reading of 116.3.

Revised data for building permits and the national Index of Leading Economic

Indicators led to the previously reported change of -0.6 percent to be revised

downward to -0.8 percent. Also

revised was the Index value and change for June. Please visit the Website

address given below to see the revised changes for the individual components.

The values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|