|

Home

Leading Economic Indicators

Down Sharply in February

Note:

The

tentative release date for next month's report is April 30.

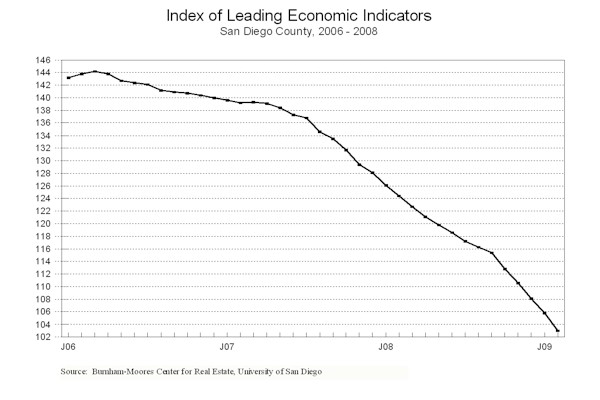

March 26, 2009 -- The University of San Diego's Index of

Leading Economic Indicators for San Diego County fell 2.7 percent in February.

Four of the six components in the Index -- building permits, initial

claims for unemployment insurance, consumer confidence, and help wanted

advertising -- were sharply negative during month, and a fifth -- the outlook

for the national economy -- was down moderately.

The only positive component was local stock prices, and it was up only

slightly. February’s decline was the

largest one month drop ever in the USD Index, and marked its 34th

decrease in 35 months.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (February)

Source: University of San Diego |

- 2.7 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (February)

Source: Construction Industry Research

Board |

- 4.93% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (February)

Source: Employment Development Department |

- 2.90% |

|

Stock Prices

San Diego Stock Exchange Index (February)

Source: San Diego Daily Transcript |

+ 0.11% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (February)

Source: San Diego Union-Tribune |

- 3.60% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (February)

Source: Monster Worldwide |

- 4.10% |

|

National Economy

Index of Leading Economic Indicators (February)

Source: The Conference Board |

-0.80% |

The outlook for the local

economy remains unchanged from recent months, and that is decidedly negative.

February’s employment report for San Diego showed that the county last an

astonishing 37,900 jobs compared to the same month last year. Sectors

experiencing the largest declines were construction (-10,100 jobs), retail trade

(-8,600), administrative and support services (-5,700), manufacturing (-5,200),

wholesale trade (-3,400), leisure and hospitality (-2,900), and finance

(‑2,500). The local economy is likely to remain in a downturn for the rest

of this year, with heavy year-over-year job losses to continue and the

unemployment rate likely to top 10 percent.

Highlights:

January’s record for the lowest number of residential units authorized by

building permits ever (87) lasted just one month as there were only 80 units

authorized in February. That puts residential authorized in January and

February down almost 78 percent compared to the first two months of 2008, which

eventually became the lowest year on record for building permits. . . There was

no relief in the labor market as both initial claims for unemployment

insurance and help wanted advertising were down. The latter

component experienced its biggest one month decline ever. The net result

was that the local unemployment rate edged up to 8.8 percent in February from

8.7 percent in January. . . Local consumer confidence hit another

all-time low in February and has now fallen more than 67 percent in the last two

years. This is important because consumer spending is typically two-thirds

of economic activity. In particular, consumers are less likely to make

commitments to big ticket items such as houses and automobiles if they are

worried about their job and income prospects. . . As was the case in January,

local stock prices bucked the trend of the broader market averages by going

up in February as opposed to going down. . . Last month, the national Index

of Leading Economic Indicators was poised to signal a turning point to the

upside in the national economy as it had been up for two months in a row.

Those hopes were dashed with February’s negative reading and a revision in the

December change from positive to negative. The final estimate for the

fourth quarter Gross Domestic Product will be released on the day this report is

released, with the national economy expected to have contracted at a worse that

previously reported rate of 6.5 percent annual rate.

February’s decrease puts the USD Index of Leading Economic Indicators for

San Diego County at 103.0, down from January’s revised reading of 105.8.

Revised data for building permits and the national Index of Leading Economic

Indicators led to a revision in the values of the USD Index for December and

January and the previously reported changes for those months. Please visit

the Website address given below to see the revised changes for the individual

components. The values for the USD Index for the last year are given

below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|