|

Home

Leading Economic Indicators

Down Sharply in January

Note:

The

tentative release date for next month's report is March 26.

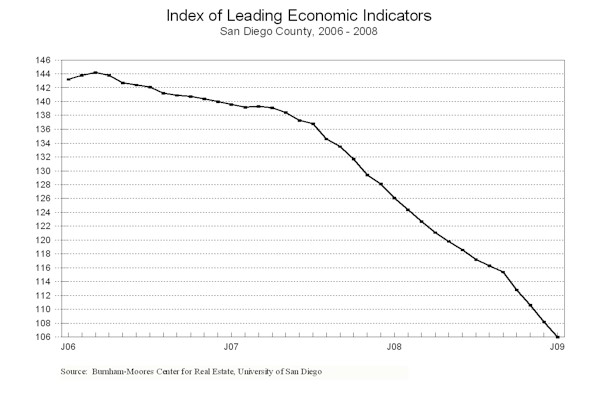

February 26, 2009 --

The University of San Diego's Index of Leading

Economic Indicators for San Diego County fell 2.0 percent in January. Sharp

declines in building permits, initial claims for unemployment insurance,

consumer confidence, and help wanted advertising overwhelmed solid gains in

local stock prices and the outlook for the national economy to push the USD

Index down for the 33rd time in 34 months. The way the Index is

calibrated, a change of one percent or more in a month is considered a very

significant change. January’s drop marked the fourth consecutive month with a

drop of two percent or more, and those four months represent the four largest

drops ever in the Index.

.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (January)

Source: University of San Diego |

- 2.0 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (January)

Source: Construction Industry Research

Board |

- 4.06% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (January)

Source: Employment Development Department |

- 3.66% |

|

Stock Prices

San Diego Stock Exchange Index (January)

Source: San Diego Daily Transcript |

+ 1.23% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (January)

Source: San Diego Union-Tribune |

- 3.07% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (January)

Source: Monster Worldwide |

- 3.53% |

|

National Economy

Index of Leading Economic Indicators (January)

Source: The Conference Board |

+0.80% |

The outlook for the local economy remains bleak at this point.

The length and the depth of the decline in the USD Index suggests that San

Diego’s economy may remain weak through the end of 2009. There is no sign of any

imminent turnaround at this point. Whether the recently passed federal stimulus

package will be enough to stabilize the local economy remains to be seen. It

should help some, as will the efforts to help homeowners avoid foreclosure. The

final element that is needed is stability in the financial system to the extent

that credit will start flowing again.

Highlights

The weakness in construction carried into 2009 as residential units

authorized by building permits fell below 100 in a month for the first time

ever in January. There were only 82 single-family units authorized during the

month, and multi-family units totaled a minuscule six units. Residential units

authorized were at an all-time low of 5,155 units in 2008, and that record could

be threatened in 2009. . . The outlook for the labor market remains grim.

Initial claims for unemployment insurance topped 30,000 for the first time

ever in January. By comparison, only about 10,000 initial claims were filed each

month at the height of the boom in the local economy. There is no help on the

hiring front, as help wanted advertising fell for the 29th

straight month. As of this writing, the local employment and unemployment

numbers for January have not been released. But the unemployment rate is

expected to approach 8 percent. This follows a year in which San Diego County

lost 5,100 jobs, which was only the fifth time in the last 30 years where

employment has dropped year-over-year. . . A big drag on the local economy is

that local consumer confidence continues to sink. As consumers become

more concerned about their futures, they cut back on their expenditures, which

threatens to make a bad situation even worse. . . After losing more than a third

of their value in 2008, local stock prices rebounded significantly in

January. . . The national Index of Leading Economic Indicators has now

been up for two months in a row. Could this signal a turnaround for the national

economy? Economists usually look for three consecutive changes in a leading

index as a signal of a turning point. This may be forecasting a bottom in the

national in the second half of 2009, as many economists are expecting.

January’s decrease puts the USD Index of Leading Economic

Indicators for San Diego County at 106.0, down from December’s revised reading

of 108.2. Revised data for building permits and the national Index of Leading

Economic Indicators caused a revision in the values of the USD Index for

November and December and the previously reported change for November. Please

visit the Website address given below to see the revised changes for the

individual components. The values for the USD Index for the last year are given

below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|