|

Home

Leading Economic Indicators

Down Sharply in November

Note:

The

tentative release date for next month's report is January 29.

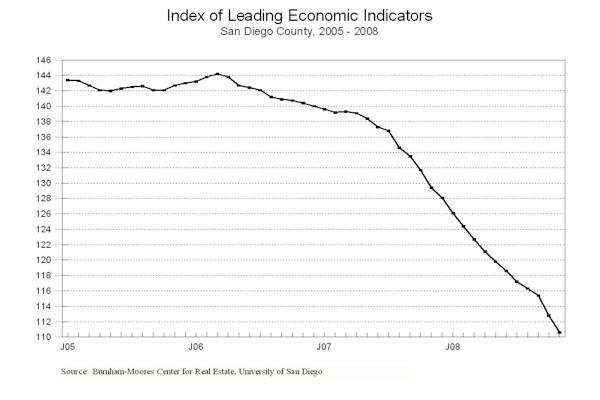

December 19, 2008 --

The

University of San Diego's Index of Leading Economic Indicators for San Diego

County fell 1.9 percent in November.

This was the second largest drop ever in the Index, topped only by October’s

drop of 2.3 percent. Every component

was down, and with the exception of the outlook for the national economy, they

were all down significantly, as defined by a more

than one percent change for the month.

With November’s drop, the USD Index has now fallen in 31 of the last 32

months.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (November)

Source: University of San Diego |

- 1.9 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (November)

Source: Construction Industry Research

Board |

- 2.01% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (November)

Source: Employment Development Department |

- 2.10% |

|

Stock Prices

San Diego Stock Exchange Index (November)

Source: San Diego Daily Transcript |

- 2.43% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (November)

Source: San Diego Union-Tribune |

- 1.98% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (November)

Source: Monster Worldwide |

- 2.29% |

|

National Economy

Index of Leading Economic Indicators (November)

Source: The Conference Board |

-0.79% |

The outlook for the local economy remains grim at this point,

at least for the short term. Job

growth has become decidedly negative, and the local unemployment rate is likely

to approach and possibly top 8 percent some time in 2009.

As was mentioned in last month’s report, a combination of lower gas

prices, a pickup in home sales spurred by lower prices and interest rates, and a

massive Federal stimulus package may bring stability to the local economy in the

second half of next year. For 2009

as a whole, job growth is expected to be in the -5,000 to zero range.

The unemployment rate is expected to average 7.5 percent, with the second

half of the year better than the first.Highlights:

Barring a surge in December, residential units authorized by building permits

are likely to fall below the levels seen in the last downturn in the early

1990s. Less than 100 single-family

units were authorized in November, the lowest number for a month on record. . .

Both sides of the labor market remain under pressure as job losses mount and

hiring plans remain weak. Initial

claims for unemployment insurance are up more than 40 percent compared to

the same month last year, and help wanted advertising has now fallen for

27 months in a row. As of this

writing, the latest report on the local unemployment rate had not been released,

but it is expected to top 7 percent. . .

In the past, local consumer confidence responded positively to

drops in the price of gasoline. But

that relationship is not holding this time around, as the negative news about

the rest of the economy overwhelms the positive news of lower gas prices. . .

The drop in the stock market continued in November, although the damage to

local stock prices was not nearly as bad as what occurred in October. . .

The National Bureau of Economic Research (NBER) has declared the national

economy in a recession, with economic activity peaking in December 2007.

Even though the Gross Domestic Product (GDP) grew in the first two

quarters of 2008, the NBER based its determination on other factors,

particularly the loss of jobs. The

national economy has lost jobs in each month of 2008, with a total of nearly 2

million jobs lost. That weakness is

finally beginning to take a toll on the GDP, with the growth rate in the third

quarter being revised downward to -0.5 percent from -0.3 percent.

The national Index of Leading Economic Indicators may have

foreshadowed the coming recession when it fell for six of seven months beginning

in August 2007.

November’s decrease puts the USD Index of Leading Economic

Indicators for San Diego County at 110.6, down from October’s revised reading of

112.7. While there was no impact on

the previously reported change for October, revisions in the data for building

permits and the national Index of Leading Economic Indicators caused the USD

Index value to be revised downward from 112.8 for the month.

Please visit the Website address given below to see the revised changes

for the individual components. The

values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|