|

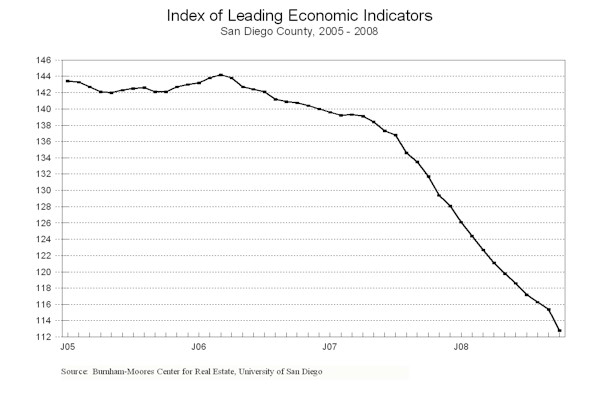

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (October)

Source: University of San Diego |

- 2.3 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (October)

Source: Construction Industry Research

Board |

- 1.58% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (October)

Source: Employment Development Department |

- 2.29% |

|

Stock Prices

San Diego Stock Exchange Index (October)

Source: San Diego Daily Transcript |

- 5.39% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (October)

Source: San Diego Union-Tribune |

- 1.39% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (October)

Source: Monster Worldwide |

- 1.31% |

|

National Economy

Index of Leading Economic Indicators (October)

Source: The Conference Board |

-1.57% |

An already difficult situation took a decided turn for the worst with the

developments in October. What started as

a problem related to real estate spread into the financial system as the

viability of some of the country's

biggest financial institutions was called into question.

The problems in the housing and financial markets in turn have impacted

the rest of the economy, as retail and auto sales have plummeted, which

threatens the loss of more jobs and further weakness in the housing and

financial markets. This downward spiral

is projected to continue through the first half of 2009.

The economy is expected to stabilize in the second half of the year due

to a combination of lower oil and gas prices, increased home sales, and another

stimulus package by the federal government.

The stimulus package will likely include massive spending on

infrastructure and relief to state and local governments among other elements.

Highlights:

After a promising spring and summer, residential units authorized by building

permits have fallen off once again, as the surge in multi-family units that

boosted permits has cooled considerably . . . The labor market outlook remains

very weak with both initial claims for unemployment insurance and help

wanted advertising remaining under pressure.

The net result was that the local unemployment rate surged to 6.8 percent

in October, the highest level since July 1995. . . The barrage of bad news on

the economy, housing, and the financial markets continues to take a toll on

local consumer confidence. With

consumers likely to be cautious in the near term, the Christmas shopping season

is projected to be one of the worst in decades. . . Local stock prices

suffered along with the other financial markets as stocks were battered by

concerns about the economy and the health of financial institutions.

The Dow Jones Industrial average fell 14 percent during the month amid

huge volatility which saw the average daily point change a mind boggling 340

points. . . The latest economic data at the national level suggests that the

downward move of the national economy is accelerating.

The preliminary estimate for real GDP growth showed that the economy

shrank by 0.3 percent in the third quarter.

On the jobs front, more than 500,000 have been lost in the last two

months, bringing the total to 1.2 million for the year so far.

The national Index of Leading Economic Indicators is signaling

continued weakness in the months ahead as it has fallen in three of the last

four months.

.

October's

decrease puts the USD Index of Leading Economic Indicators for

San Diego County

at 112.8, down from September's

reading of 115.4. Revised data for

building permits and the national Index of Leading Economic Indicators led to

the previously reported change of -0.8 percent to be revised to -0.7 percent.

Please visit the Website address given below to see the revised changes

for the individual components. The

values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact: