|

Home

Leading Economic Indicators

Up in May

Note:

The

tentative release date for next month's report is July 28.

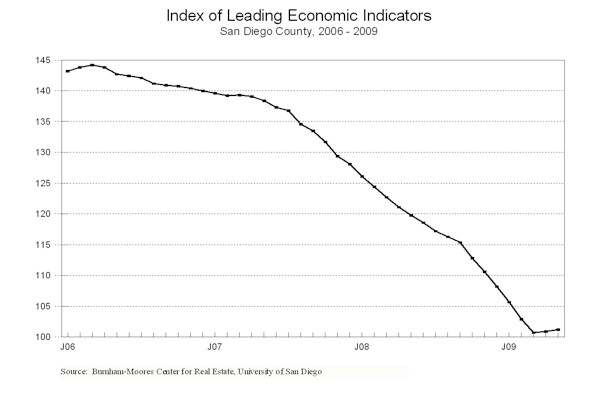

June 25, 2009 -- The University of San Diego's Index of Leading Economic

Indicators for San Diego County rose 0.3 percent in May. Another strong gain in local consumer confidence powered the USD Index to

its second consecutive gain after 24 straight down months. Also supporting the advance were sharp increases in local stock prices

and the outlook for the national economy, along with a smaller rise in building

permits. On the downside, the labor market variables continue to plunge, with both initial claims for unemployment

insurance and help wanted advertising sharply negative.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (May)

Source: University of San Diego |

+ 0.3 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (May)

Source: Construction Industry Research

Board |

+ 0.47% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (May)

Source: Employment Development Department |

- 3.12% |

|

Stock Prices

San Diego Stock Exchange Index (May)

Source: San Diego Daily Transcript |

+ 1.17% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (May)

Source: San Diego Union-Tribune |

+ 4.22% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (May)

Source: Monster Worldwide |

- 3.46% |

|

National Economy

Index of Leading Economic Indicators (May)

Source: The Conference Board |

+2.39% |

At this point, cautious optimism needs to be exercised with

respect to the local economy. Another positive reading for June would be

the third in a row for the USD Index and would give the traditional signal of a

bottom for San Diego’s economy. That trough though would still be roughly

six to 12 months in the future. As was mentioned in last month’s report,

the rebound is likely to be relatively weak, given that the positive numbers in

the leading indicators have not been very strong. Finally, even after the

economy turns around, unemployment is still likely to be high as businesses tend

to be cautious in terms of hiring coming out of a slump. Still, the

outlook is better than just two months ago, and a flat local economy is better

than one that is declining.

Highlights:

While residential units authorized by building permits are down on a

year-over-year basis, the trend continues to be positive month-to-month,

particularly when compared to the record low levels registered in earlier in the

year. Any pickup in construction activity would be welcome as construction

employment has fallen by almost 30,000 since its peak in June 2006. . . Job

losses continue to be high as initial claims for unemployment insurance

topped the 30,000 mark for the fifth consecutive month. Hiring also

remains weak, with help wanted advertising now having fallen for 34

straight months. The net result was that the local unemployment rate edged

closer to the 10 percent mark with a reading of 9.4 percent in May and the

year-over-year job loss countywide topping 50,000. . . The USD Index uses a

moving average to smooth the month-to-month fluctuations that sometimes distort

the trend in the data. Based on this, local consumer confidence is

up sharply when compared to the low levels of recent months. This is

significant given that consumption typically represents two-thirds to 70 percent

of economic activity. . . The rally in local stock prices continued

in May as the financial markets signaled optimism in the prospects for San

Diego-based companies. . . After registering its biggest gain since June 2005 in

April, the national Index of Leading Economic Indicators did even better

in May. While the news on the national economy remains grim, things appear

to be “less bad” than in recent months. Examples include job losses and

the number of initial claims for unemployment insurance being lower than in

previous months. Also, the contraction in GDP for the first quarter was

revised to a 5.7 percent annualized rate, down from the 6.1 percent drop

originally estimated.

May’s decrease puts the USD Index of Leading Economic Indicators for San Diego

County at 101.2, up from April’s reading of 100.9. Revised data for

building permits in April and for the national Index of Leading Economic

Indicators for January through April affected only the previously reported level

of the USD Index for January. Please visit the Website address given below

to see the revised changes for the individual components. The values for

the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|