|

Home

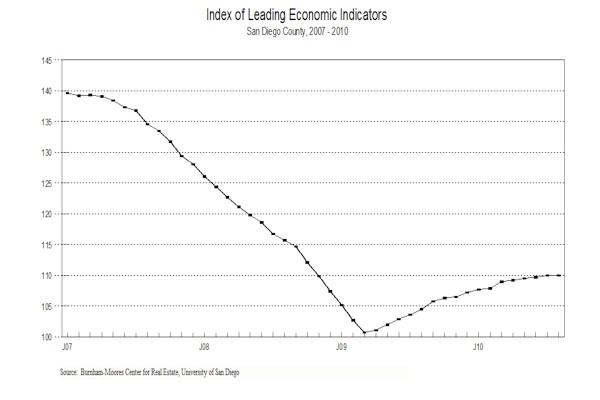

Leading Economic Indicators

Up in August

Note:

The tentative release date for next month's report is October 26.

September 29, 2010 --

The

USD Burnham-Moores Center for Real Estate's

Index of Leading Economic Indicators for San Diego

County was unchanged in August. Although there was no decline, the unchanged

reading breaks a string of 16 consecutive increases in the USD Index. Four of

the components were up: Help wanted advertising and the outlook for the national

economy registered medium-sized gains while local stock prices and consumer

confidence were positive but virtually unchanged. Rounding out a month that saw

no significant changes in either direction, building permits declined moderately

while initial claims for unemployment insurance were slightly negative.

|

Index of Leading Economic

Indicators

The index for San Diego County that includes the

components listed below (August)

Source: USD Burnham-Moores Center for Real Estate |

+ 0.0 % |

|

Building Permits

Residential units

authorized by building permits in San Diego County (August)

Source: Construction Industry Research

Board |

- 0.64% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted

(August)

Source: Employment Development Department |

- 0.13% |

|

Stock Prices

San Diego Stock Exchange Index (August)

Source:

San Diego Daily Transcript |

+ 0.08% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (August)

Source:

San Diego Union-Tribune |

+ 0.02% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (August)

Source: Monster Worldwide |

+ 0.35% |

|

National Economy

Index of Leading Economic Indicators (August)

Source: The Conference Board |

+ 0.53% |

August’s unchanged reading is the latest sign

of continued choppiness in the local economy. The USD Index has still not turned

negative, so there is no sign of an impending downturn. But growth in the local

economy is likely to be uneven, with fits and starts along the way. Job growth

continues to be weak and will likely remain so for a long time. While better

than in previous months, the economy is down almost 10,000 jobs in August

compared to the same time last year. Among the hardest hit sectors are

manufacturing (down 2,900 jobs), leisure and hospitality (2,700), government

(2,300), retailing (2,200), finance and real estate (2,200), and construction

(1,500). The only sectors showing year-over-year gains are health

care (up 2,600) and

business and professional

services (2,700). The latter category is important because it is largely due to

big increases in temporary employment, which is often a precursor to full-time

employment.

Highlights:

Residential units authorized by building permits turned negative in August

after advancing for eight months in a row. Despite the downturn, permits are

still more than 32 percent ahead of the pace of 2009. One indication of the

difference in the two years is that 141 multi-family units were authorized in

August this year versus only six in August of 2009. . . The labor market

components remain mixed, although the rate of change slowed for both. Initial

claims for unemployment insurance were negative for the fifth consecutive

month, but the drop was the smallest of the five months. On the hiring side of

the labor market, help wanted advertising rose for the tenth straight

month, but the gain was less than in recent months. The net result was that the

local unemployment rate fell to 10.6 percent in August from a rate of 10.9

percent in July. . . The trend in local consumer confidence has shifted

to being virtually flat after recent gains. The raw value for consumer

confidence actually fell sharply in August, but the USD Index uses a moving

average to smooth out month-to-month fluctuations and capture the overall trend.

. . Local stock prices are calculated using the average daily value for

the entire month. That methodology yielded a gain for local stocks in August,

even though stock prices fell by more than five percent from the beginning of

the month to the end. The average daily value in August was higher than the

average daily value in July. …. Despite concerns about a double dip recession,

the national Index of Leading Economic Indicators has now been up in 15

of the last 17 months.

August’s increase puts the USD Index of Leading Economic Indicators for San

Diego County at 110.0, unchanged from July’s revised reading. Revised values for

building permits for July and for the national Index of Leading Economic

Indicators for June and July led to revisions in the Index for those months but

did not affect the previously reported changes. Please visit the Website address

given below to see the revised changes for the individual components. The values

for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|