|

Home

Leading Economic Indicators

Unchanged in November

Note:

The tentative release date for next month's report is January 28.

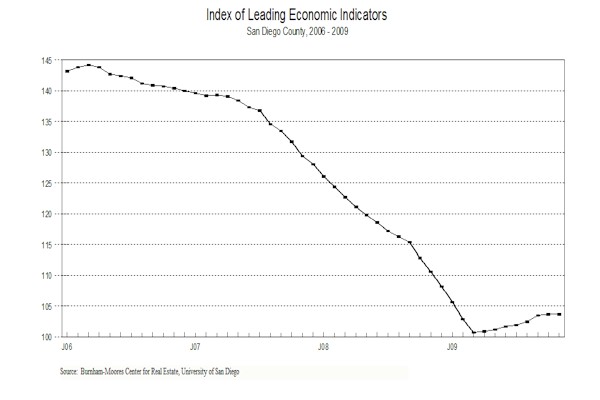

January 7, 2010 --

The University of San Diego's Index of Leading Economic

Indicators for San Diego County was unchanged in November. Two of the

components--consumer confidence and the outlook for the national economy--were

up sharply during the month, and there was also a small increase in help wanted

advertising. On the downside, local stock prices took a big tumble during the

month. Building permits and initial claims for unemployment were also negative,

but there were only slight declines in those components.

|

Index of Leading Economic

Indicators

The index for San Diego County that includes the

components listed below (November)

Source: University of San Diego |

+ 0.0 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (November)

Source: Construction Industry Research

Board |

-0.28% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (November)

Source: Employment Development Department |

- 0.17% |

|

Stock Prices

San Diego Stock Exchange Index (November)

Source: San Diego Daily Transcript |

-2.84% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (November)

Source: San Diego Union-Tribune |

+ 1.16% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (November)

Source: Monster Worldwide |

+ 0.08% |

|

National Economy

Index of Leading Economic Indicators (November)

Source: The Conference Board |

+1.71% |

November’s unchanged reading broke a string of

seven consecutive increases for the USD Index. There is no change though in the

previously reported outlook for 2010. The first few months of the year may be

weak, with the local unemployment rate edging up to approach 11 percent. Things

will improve in the second half of the year, with a net overall gain of between

3,000 to 5,000 jobs for the year. An improving housing market will boost

employment in construction, while research and development and health services

will remain relatively strong. Rebounding local and national economies will

stabilize employment in retailing and in the leisure and hospitality sector.

However, job losses are expected to continue in manufacturing, which has lost

jobs in 10 of the last 11 years.

Highlights: The roller coaster ride for

residential units authorized by building permits continues with that

component flipping back to the negative side after two up months. It is likely

that there will be fewer than 3,000 units authorized by building permits in

2009, which would be down more than 40 percent from the previous low of 5,154

units authorized in 2008. The forecast is for 4,000 units to be authorized in

2010. . . There was significant improvement in the labor market components in

November. While Initial claims for unemployment insurance still rose (a

negative for the Index), the change in November was the lowest since February of

2008. The implication is that the local economy may be reaching a peak In terms

of layoffs and job losses. On the hiring front, help wanted advertising

turned positive for the first time after 38 consecutive monthly declines,

although the gain was not large. The net result was that the local unemployment

rate was 10.3 percent in November, which was down from the revised 10.7 percent

rate in October but still the sixth month in a row that the local unemployment

rate was in double digits. . . The trend in local consumer confidence

remains positive. As has been mentioned previously, a moving average is used to

determine the trend by smoothing out the month-to-month fluctuation in the data.

The San Diego Union-Tribune reports that local consumer confidence is up

more than 30 percent compared to the same month in 2008. . . Local stock

prices fell for the third straight month even though the broader market

averages were up in November. . . The outlook for the national economy continues

to be positive, with the national Index of Leading Economic Indicators

increasing for the seventh consecutive month. There are increasing signs that

the national economy is recovering, although the Gross Domestic Product growth

rate was revised downward to 2.2 percent for the third quarter.

November’s increase puts the USD Index of Leading Economic Indicators for San

Diego County at 103.7, unchanged from October’s reading. A revision in the

national Index of Leading Economic Indicators for September led to a change in

the value of the USD Index for that month but no revision in the previously

reported change of +1.0 percent. Please visit the Website address given below to

see the revised changes for the individual components. The values for the USD

Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|