|

Home

Leading Economic Indicators

Unchanged in October

Note:

Due to the holidays, the release date for next month's report is uncertain.

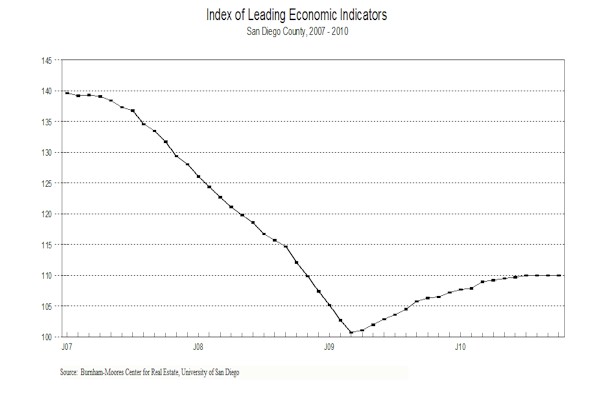

November 30, 2010 -- The

USD Burnham-Moores Center for Real Estate’s Index of Leading Economic Indicators

for San Diego County was unchanged in October, despite the fact that five of the

six components in the Index were positive during the month. The outlook for the

national economy was up sharply, initial claims for unemployment insurance and

local stock prices were moderately positive, and consumer confidence and help

wanted advertising also increased, but just barely. These gains were offset by a

huge drop in building permits to leave the USD Index unchanged for the third

straight month.

|

Index of Leading Economic

Indicators

The index for San Diego County that includes the

components listed below (October)

Source: USD Burnham-Moores Center for Real Estate |

+ 0.0 % |

|

Building Permits

Residential units

authorized by building permits in San Diego County (October)

Source: Construction Industry Research

Board |

- 2.21% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted

(October)

Source: Employment Development Department |

+ 0.48% |

|

Stock Prices

San Diego Stock Exchange Index (October)

Source:

San Diego Daily Transcript |

+ 0.65% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (October)

Source:

San Diego Union-Tribune |

+ 0.04% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (October)

Source: Monster Worldwide |

+ 0.09% |

|

National Economy

Index of Leading Economic Indicators (October)

Source: The Conference Board |

+ 1.05% |

There was some initial

concern when last month’s report showed the first drop in the USD Index in 18

months. But that decline was revised upward to unchanged (see below), so no

turning point to the downside has been signaled. The outlook remains for slow

but positive growth for the local economy at least through the first half of

2011. One area that has been improving has been the labor market. While the news

is still bad, with the unemployment rate above 10 percent now for 17 straight

months, the situation is relatively better than during the depths of the

downturn. In October, non-farm wage and salary employment was down 1,100 from

October 2009, which was the best year-over-year comparison since April 2008.

With hints of a stronger Christmas buying season, it is likely that the

year-over-year comparison will turn positive in November and December for the

first time since the Great Recession began.

Highlights: Residential units authorized by building

permits fell to their lowest level of 2010 in October. While single-family

permits are still holding up, multi-family units are down slightly through

October compared to the same period in 2009 . . . The labor market components

were both positive for the first time since March of this year. The pace of job

loss slowed, with initial claims for unemployment insurance hitting the

lowest level of the year, both in absolute and in seasonally adjusted terms. The

hiring side of the market was virtually unchanged, although slightly positive,

with help wanted advertising increasing for the 12th

consecutive month. The net result was that the local unemployment rate dropped

to 10.2 percent in October, which is down from the 10.6 percent rate of

September. . . Local consumer confidence remains volatile on a

month-to-month basis, with the actual value of the index down for October

compared to September. But when the volatility is smoothed out using a moving

average, the trend is still slightly positive. . . After slumping in the late

spring and early summer, local stock prices advanced for a third straight

month, following the rally in the broader financial markets. . . The national

Index of Leading Economic Indicators turned in a second strong advance and

has now been up four months in a row. The "second" estimate for Gross Domestic

Product (GDP) for the third quarter showed growth at a 2.5 percent annualized

rate, up from the 1.7 growth rate of the second quarter and the fifth

consecutive quarter of positive GDP growth.

October’s unchanged reading puts the USD Index of Leading

Economic Indicators for San Diego County at 110.0, the same as September’s

revised level. A big upward revision in the national Index of Leading Economic

Indicators caused the change in September to be revised upward to unchanged from

the previously reported drop of 0.1 percent. Please visit the Website address

given below to see the revised changes for the individual components. The values

for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|