|

Home

Leading Economic Indicators

Down Sharply in July

Note: The tentative date for the

release of next month's

report is September 30.

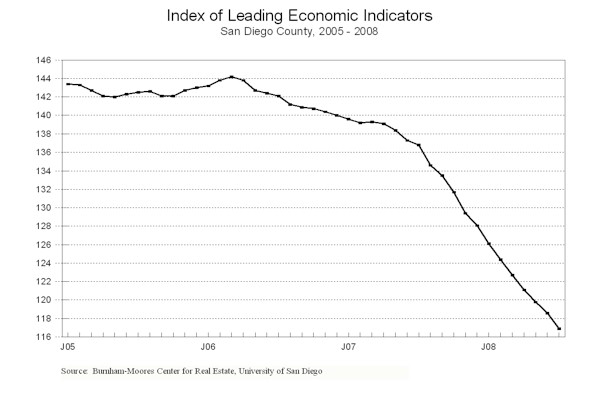

August 28, 2008 -- The University of San Diego's Index of

Leading Economic Indicators for San Diego County fell 1.5 percent in July.

Leading the way to the downside were sharp drops in consumer confidence,

initial claims for unemployment insurance, and the outlook for the national

economy. Two other components - -

local stock prices and help wanted advertising - - were also down moderately.

On the positive side, building permits were up, albeit only slightly so.

July’s drop was the tenth consecutive significant decrease in the USD

Index, which has fallen in 27 of the last 28 months.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (July)

Source: University of San Diego |

- 1.5 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (July)

Source: Construction Industry Research

Board |

+ 0.17% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted (July)

Source: Employment Development Department |

- 1.89% |

|

Stock Prices

San Diego Stock Exchange Index (July)

Source: San Diego Daily Transcript |

- 0.58% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (July)

Source: San Diego Union-Tribune |

- 4.72% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (July)

Source: Monster Worldwide |

- 0.74% |

|

National Economy

Index of Leading Economic Indicators (July)

Source: The Conference Board |

- 1.35% |

The outlook for the local economy continues to be negative,

with no signs of a rebound in sight.

Job growth remains negative, although most of the damage remains in the real

estate sectors (construction, lending, and real estate).

The only areas outside of real estate that are being adversely affected

have some connection to the housing slump, such as home furnishings and

appliance stores, as well as home improvement stores.

One positive development is the drop in gasoline prices, which have

fallen more than 70 cents per gallon since the peak earlier this summer.

Highlights:

The trend in residential units authorized by building permits was

positive for a second month in a row, even though the number of permits for July

was low. A moving average of the

data is used to capture trends and smooth random month-to-month fluctuations. .

. The news continues to be bad on both sides of the labor market.

The pace of job losses continues to be

high, as evidenced by elevated levels of initial claims for unemployment

insurance. Hiring remains weak,

with help wanted advertising falling for the 23rd month in a

row. The net result was that the

local unemployment rate jumped to 6.4 percent in July from a revised 6.0 percent

in June, marking the first time the unemployment rate has topped 6 percent since

the 1990s. . . Local consumer confidence continues to be at historically

low levels, and is down more than 50 percent from a year ago.

Historically, there has been a strong inverse correlation between local

consumer confidence and gasoline prices.

It remains to be seen whether the recent decline in local gasoline prices

will be enough to turn around the negative feelings among consumers. . .

Although local stock prices started to rebound towards the end of the

month, the average daily close for July was down compared to June. . . The

national Index of Leading Economic Indicators registered its largest drop

since August of last year. News on

the national economy remains mixed.

Although the advance estimate of Gross Domestic Product growth for the second

quarter of 2008 was a positive 1.9 percent, the first quarter growth was revised

downward to 0.9 percent and growth in the fourth quarter of 2007 was revised

downward to a negative 0.2 percent.

July’s decrease puts the USD Index of

Leading Economic Indicators for San Diego County at 116.9, down from June's

revised reading of 118.6. Revised data on building permits and the national

Index of Leading Economic Indicators led to revisions in the USD Index value for

April, May, and June, and to revisions in the previously reported changes for

April and May. Please visit the

Website address given below to see the revised changes for the individual

components. The values for the USD

Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|