|

Home

Leading Economic Indicators

Up in December

Note:

The tentative release date for next month's report is February 24.

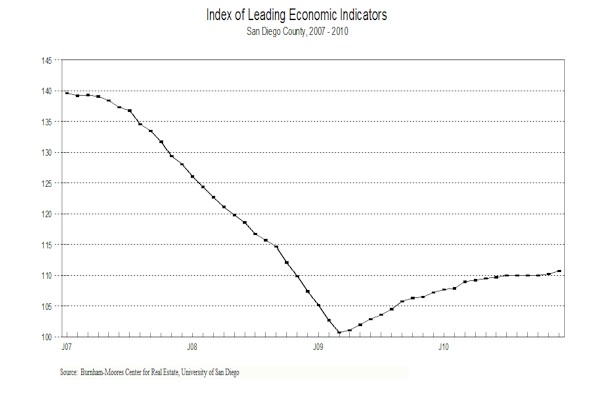

January 28, 2011 -- The

USD Burnham-Moores Center for Real Estate’s Index of Leading Economic Indicators

for San Diego County rose 0.4 percent in December. Sharp increases in local

stock prices and the outlook for the national economy pushed the USD Index to a

second consecutive gain after having been unchanged for three months in a row.

On the downside, building permits remain weak as construction activity continues

to lag. Local consumer confidence, initial claims for unemployment insurance,

and help wanted advertising were virtually unchanged, with the former slightly

positive and the latter two slightly negative.

|

Index of Leading Economic

Indicators

The index for San Diego County that includes the

components listed below (December)

Source: USD Burnham-Moores Center for Real Estate |

+ 0.4 % |

|

Building Permits

Residential units

authorized by building permits in San Diego County (December)

Source: Construction Industry Research

Board |

- 0.72% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted

(December)

Source: Employment Development Department |

- 0.08% |

|

Stock Prices

San Diego Stock Exchange Index (December)

Source:

San Diego Daily Transcript |

+ 1.22% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (December)

Source:

San Diego Union-Tribune |

+ 0.05% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (December)

Source: Monster Worldwide |

- 0.03% |

|

National Economy

Index of Leading Economic Indicators (December)

Source: The Conference Board |

+ 1.92% |

With December’s gain, the

USD Index has now risen or been unchanged for 21 straight months. As mentioned

last month, the forecast is for the local economy to add between 10,000 and

15,000 jobs in 2011, compared to 6,300 gained in 2010. The gain is based on

expected solid growth in the national economy, and a rebound in tourism and

construction locally. Potential problems that could slow the rebound are a

continued high level of foreclosures and the impact of high unemployment, which

has topped 10 percent locally for 19 consecutive months. Also, budget deficits

at every level of government could lead to tax increases and/or big cutbacks in

spending and employment, both of which would slow the economic recovery. A last

potential problem is the recent spike in gas prices, which if it lasts would

reduce consumer buying power and increase prices of goods shipped into the

region.

Highlights: The trend

in residential units authorized by building permits remained negative for

the fifth month in a row, and 2010 was the second worst year ever for building

permits . Despite this, residential units authorized were up almost 12 percent

for the year compared to 2009. Single-family units authorized increased by more

than 24 percent, while multi-family units fell by almost 7 percent . . . For the

first time since September 2009, both initial claims for unemployment

insurance and help wanted advertising were negative, although both

were barely so. Despite that, the local unemployment rate fell to 10.1 percent

in December, down from 10.4 percent in November. . . Although local consumer

confidence has been up for eight months in a row, it remains relatively

flat. It remains to be seen if consumer confidence will be negatively affected

by the recent rise in gas prices; there has been a strong negative correlation

between those two variables in the past. . . 2010 was a good year for local

stock prices, which were up almost 18 percent and finished the year with a

five month winning streak. . . The outlook for the national economy continues to

be strongly positive, with the national Index of Leading Economic Indicators

up for the sixth consecutive month and now up 19 times in the last 21 months.

The advance estimate of GDP growth for the 4th quarter showed the

national economy growing at a 3.2 percent annualized rate, compared to a growth rate

of 2.6 percent in the 3rd quarter.

December’s increase puts the USD Index of Leading Economic Indicators for San

Diego County at 110.7, up from November’s revised reading of 110.2. Although

there was no change in the previously reported increase of 0.3 percent in

November. a revision in the data for building permits led to a drop in the level

of the USD Index for the month. Please visit the Website address given below to

see the revised changes for the individual components. The values for the USD

Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|