|

Home

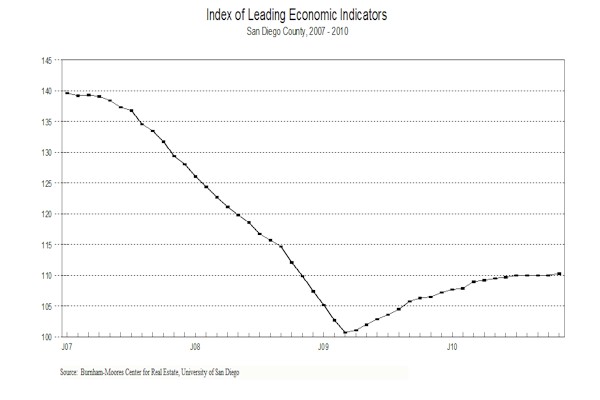

Leading Economic Indicators

Up in November

Note:

The tentative release date for next month's report is January 28.

December 21, 2010 -- The USD Burnham-Moores

Center for Real Estate’s Index of Leading Economic Indicators for San Diego

County rose 0.3 percent in November. Leading the way to the upside were big

gains in the outlook for the national economy and initial claims for

unemployment insurance. There were smaller increases in local stock prices and

consumer confidence. These outweighed another sharp drop in building permits and

a small decrease in help wanted advertising to help break a string of three

straight months where the USD Index was unchanged.

|

Index of Leading Economic

Indicators

The index for San Diego County that includes the

components listed below (November)

Source: USD Burnham-Moores Center for Real Estate |

+ 0.3 % |

|

Building Permits

Residential units

authorized by building permits in San Diego County (November)

Source: Construction Industry Research

Board |

- 1.86% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted

(November)

Source: Employment Development Department |

+ 1.21% |

|

Stock Prices

San Diego Stock Exchange Index (November)

Source:

San Diego Daily Transcript |

+ 0.22% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (November)

Source:

San Diego Union-Tribune |

+ 0.21% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (November)

Source: Monster Worldwide |

- 0.13% |

|

National Economy

Index of Leading Economic Indicators (November)

Source: The Conference Board |

+ 2.09% |

November’s gain marked the 20th

consecutive month where the USD Index has either increased or remained

unchanged. The outlook then remains unchanged from that of recent months: Slow

to moderate growth is expected in the local economy for at least most of 2011. A

key development occurred in the local labor market in November, when nonfarm

wage and salary employment increased by 100 compared to the same month in 2009.

While the gain was tiny, it was the first time since the downturn began in April

2008 that the year-over-year employment comparison was positive. The forecast

for 2010 is for a gain of 10,000 to 15,000 jobs, with healthcare, business and

professional services, leisure and hospitality, and construction to be the

biggest gainers. Manufacturing and government are the sectors to remain under

the most pressure.

Highlights: The trend in residential units

authorized by building permits remains negative. Residential units

authorized will be up this year compared to last, but will still be the second

lowest on record. Permits in 2011 are expected to be up significantly to about

4,500 to 5,000 for the year. This will partly be due to firmness in the housing

market, where prices are expected to increase 5 to 7 percent as employment

rebounds. . . After a month in which both components were positive for the first

time since March, the labor market variables turned mixed again in November.

Initial claims for unemployment insurance fell below 20,000 in a month for

the first time since September 2008. The hiring side of the market was weak

though, with help wanted advertising dropping for the first time in a

year. The net result was that the local unemployment rate rose to 10.4 percent

in November, up from 10.3 percent in October. . . Local consumer confidence

edged up for the seventh straight month. Except for July, though, most of those

increases have been relatively small, indicating that consumers are optimistic,

but only cautiously so. As mentioned previously, it will take significant

improvement in the labor market and the unemployment rate before consumer

confidence really begins to surge. . . Local stock prices were up again

in November, as investors remained positive about the prospects for San

Diego-base companies. . . The news for the national economy remains positive,

with the national Index of Leading Economic Indicators up for the fifth

straight month. Like the local economy, growth nationally is expected to be slow

to moderate, with GDP growth in the range of 3 to 3.5 percent in 2011. While

better than in recent quarters, the growth will not be enough to generate a

large number of jobs. As a result, the national unemployment rate is likely to

remain in the high 8 percent range.

November’s increase puts the USD Index of Leading Economic Indicators for San

Diego County at 110.3, up from October’s reading of 110.0. Although the data for

building permits were revised for October and the national Index of Leading

Economic Indicators was revised for September and October, there was no change

to the previously reported values for the USD Index or the changes for those

months. Please visit the Website address given below to see the revised changes

for the individual components. The values for the USD Index for the last year

are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|