|

Home

Leading Economic Indicators

Up in May

Note:

The tentative release date for next month's report is July 27.

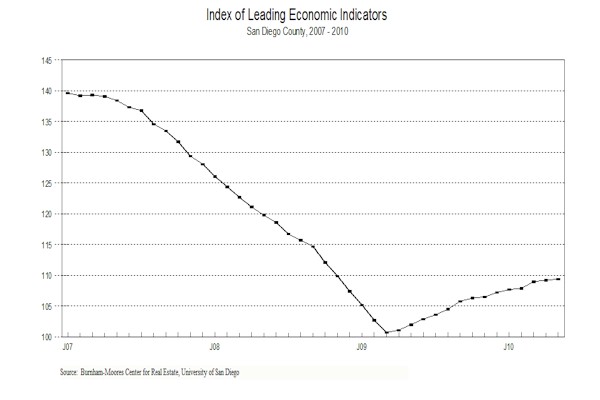

June 30, 2010 --

The University of San Diego's Index of Leading

Economic Indicators for San Diego County rose 0.2 percent in May. The advance

was the 14th in a row for the USD Index and was led by a big surge in

building permits. There were also moderate gains in help wanted advertising and

the outlook for the national economy, as well as a minor turnaround in local

consumer confidence. On the downside, local stock prices were down sharply, and

initial claims for unemployment insurance rose, which is a negative for the

Index.

|

Index of Leading Economic

Indicators

The index for San Diego County that includes the

components listed below (May)

Source: University of San Diego |

+ 0.2 % |

|

Building Permits

Residential units

authorized by building permits in San Diego County (May)

Source: Construction Industry Research

Board |

+ 1.10% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego County, inverted,

estimated (May)

Source: Employment Development Department |

- 0.38% |

.gif) |

Stock Prices

San Diego Stock Exchange Index (May)

Source:

San Diego Daily Transcript |

- 1.09% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (May)

Source:

San Diego Union-Tribune |

+ 0.20% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (May)

Source: Monster Worldwide |

+ 0.81% |

|

National Economy

Index of Leading Economic Indicators (May)

Source: The Conference Board |

+ 0.71% |

The outlook for the local economy remains

unchanged from recent months: San Diego is likely to have slow to moderate

growth for the rest of 2010 and into at least the first half of 2011. One

potential problem impacting the recovery is the fiscal problems faced by all

levels of government, particularly the huge budget deficit faced by the state of

California. Since tax increases have been ruled out, there are likely to be big

cuts in state services and employment, especially in education, which is the

biggest part of the state budget. While higher education appears to have been

spared in the budgets proposed so far, there continues to be pressure on K-12

education. Layoffs there would hurt not only in the short term due to the

reduction of consumer spending power, but the long term prospects for the local

economy could be impacted as well with a less educated workforce.

Highlights:

Residential units authorized by building permits hit their highest level

in more than a year (since March 2009) as permit activity picked up in

multi-family units. . . The labor market components continue to be mixed.

Initial claims for unemployment insurance were negative for the second month

in a row, indicating little relief in terms of job losses. It should be noted

that the initial claims data used here involve only claims filed due to job

losses as opposed to those filed as part of the extension on benefits passed by

Congress. The hiring side of the market continues to firm, with help wanted

advertising advancing for the seventh consecutive month. The net result was

that the local unemployment rate dropped to 10.0 percent in May from a rate of

10.4 percent in April. . . Local consumer confidence ended a four month

downturn with a gain in May, with the raw data for local consumer confidence

hitting its highest level since last September. . . Concerns about the strength

of the recovery in the national economy and worries about financial difficulties

internationally caused weakness in the financial markets that negatively

affected local stock prices. . . Revised data for April showed that the

national Index of Leading Economic Indicators was unchanged in the month

as opposed to the previously reported drop. That means that the national Index

has now advanced or been unchanged for 14 straight months. Despite that, there

is concern about the strength of the recovery in the national economy. The

latest evidence was the work jobs report for May, which came in with a very weak

gain of only 41,000 new private sector jobs. For now, the outlook remains

positive, but the possibility of a double dip recession remains as unemployment

remains high and consumer spending has slowed.

May’s increase puts the USD Index of Leading Economic

Indicators for San Diego County at 109.4, up from April’s reading of 109.2.

Revisions in the data for building permits, initial claims for unemployment

insurance, and the national Index of Leading Economic Indicators did not change

the Index level for April but caused the change for the month to be revised

downward to a gain of 0.1 percent instead of the previously reported gain of 0.2

percent. Please visit the Website address given below to see the revised changes

for the individual components. The values for the USD Index for the last year

are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|