|

Home

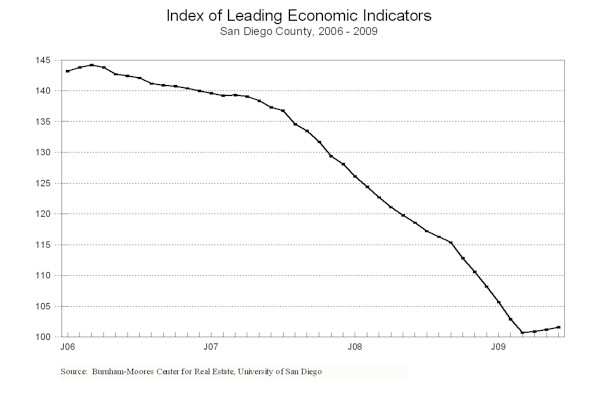

Leading Economic Indicators

Up in June

Note:

The

tentative release date for next month's report is August 27.

July 28, 2009 -- The

University of San Diego's Index of Leading Economic Indicators for San Diego County rose 0.4 percent in June. The recent

pattern of a sharp rise in consumer confidence supported by solid advances in

building permits, local stock prices, and the outlook for the national economy

pushed the USD Index to its third gain in a row after being down the previous 24

months. The positive news is

tempered somewhat by the fact that initial claims for unemployment insurance and

help wanted advertising both continue to be sharply negative.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (June)

Source: University of San Diego |

+ 0.4 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (June)

Source: Construction Industry Research

Board |

+ 0.68% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (June)

Source: Employment Development Department |

- 2.89% |

|

Stock Prices

San Diego Stock Exchange Index (June)

Source: San Diego Daily Transcript |

+ 0.88% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (June)

Source: San Diego Union-Tribune |

+ 4.65% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (June)

Source: Monster Worldwide |

- 2.26% |

|

National Economy

Index of Leading Economic Indicators (June)

Source: The Conference Board |

+1.38% |

With its third consecutive increase, the USD Index has given

the traditional signal of a turning point in the local economy. The

typical time frame involved with the local leading indicators would suggest a

possible bottom in the first half of 2010. That bottom would take the form

of continued strong home sales, a pickup in retail sales, and a stabilization of

the labor market. Reasons for the reversal would include the continued

rebound in home sales due to low prices and interest rates, relatively low gas

prices, the impact of the federal stimulus package and other programs to deal

with the economy, and a turnaround in the national economy. As has been

mentioned previously, the rebound from the bottom is likely to be weak; indeed,

the local economy could remain at the bottom for a while before it starts to

grow significantly again.

Highlights:

Residential units authorized by building permits continue to rebound from

the historic lows set in January and February, but still ended the first half of

2009 down 47 percent compared to the same period in 2008. Single-family units were off 36 percent during that period, while

multi-family units were down 56 percent. . . The employment situation remains

grim. There were more than 37,000

initial claims for unemployment insurance filed during June, a record high

number. The raw data for help

wanted advertising has been steady over the last few months, but the

seasonally adjusted trend remains sharply negative.

The net result was that the local unemployment rate topped the 10 percent

mark, hitting 10.1 percent in June with year-over-year job loss totaling almost

55,000. . . Another strong performance pushed local consumer confidence

to a level nearly 16 percent higher than in June 2008.

As has been the case in recent months, consumers' views of the current

situation remain depressed, but the outlook for the future has brightened

considerably. . . Local stock

prices moved up for the third month in a row as the financial markets

continue to rally from the March lows. . . Like the local index, the national

Index of Leading Economic Indicators advanced for the third month in a row,

signaling a potential turning point for the national economy.

Expectations among many economists are for another down quarter (the

fourth in a row) for Gross Domestic Product (GDP) growth in the second quarter,

with GDP growth turning positive in the second half of 2009.

This would help San Diego companies with

national markets, as well as the local tourism industry.

GDP growth for 2009 as a whole is expected to be in the -1.0 to -2.0

percent range.

June's decrease puts the USD Index of Leading Economic Indicators for San Diego County

at 101.6, up from May's reading of 101.2.

There were revisions to the data for building permits in May and the

national Index of Leading Economic Indicators in April and May, but they did not

affect the percentage change or the previously reported level of the USD Index

for those months. Please visit the

Website address given below to see the revised changes for the individual

components. The values for the USD

Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|