|

Home

Leading Economic Indicators

Down Sharply in December

Note:

The

tentative release date for next month's report is February 26.

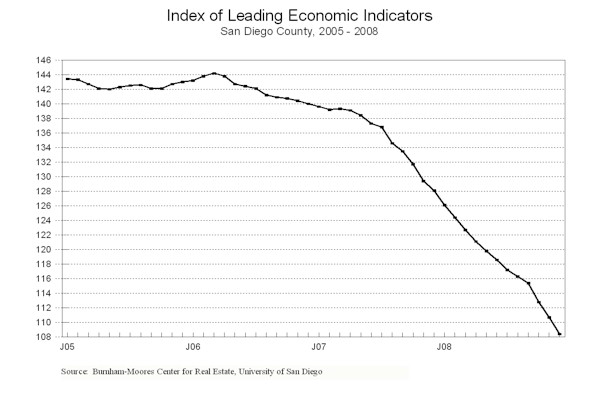

January 29, 2009 --

The University of San Diego's Index of Leading Economic Indicators for

San Diego

County fell 2.1 percent in

December. Huge drops in building permits,

initial claims for unemployment insurance, consumer confidence, and help wanted

advertising pushed the Index to its second worst monthly drop ever.

Local stock prices were also down, albeit only moderately, while the

outlook for the national economy actually edged upward.

The USD Index has now fallen in 32 of the last 33 months, with the three

largest drops ever in the last three months.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (December)

Source: University of San Diego |

- 2.1 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (December)

Source: Construction Industry Research

Board |

- 3.03% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (December)

Source: Employment Development Department |

- 3.49% |

|

Stock Prices

San Diego Stock Exchange Index (December)

Source: San Diego Daily Transcript |

- 0.67% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (December)

Source: San Diego Union-Tribune |

- 2.95% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (December)

Source: Monster Worldwide |

- 3.02% |

|

National Economy

Index of Leading Economic Indicators (December)

Source: The Conference Board |

+0.59% |

The outlook remains unchanged from recent months. The

local economy is expected to be weak for at least the first half of 2009, with

job losses in particular expected to mount. While job losses had

previously been confined to real estate-related areas (construction, credit,

real estate), the damage is now spreading into other sectors of the local

economy. Retailing has been heavily impacted, with a weak Christmas buying

season causing retail employment to fall by 8,500 jobs in December compared to

the same month a year ago. The numbers are expected to worsen with the

post-holiday closing of stores such as Mervyn's, Circuit City,

and Linens

'n Things.

Highlights: A terrible year for

construction ended with residential units authorized by building permits

reaching the lowest monthly level on record, dating back to at least 1973.

Total units authorized fell by 31 percent for the year as a whole, with the

damage roughly evenly spread in single-family permits (down 33 percent) and

multi-family ones (down 29 percent). . . Both sides of the labor market continue

under heavy pressure. Big job losses have led to a surge in initial

claims for unemployment insurance (a negative for the Index) at the same

time that hiring, as measured by help wanted advertising, is dropping

rapidly. The net result of this is that the local unemployment rate surged

above 7 percent in December to 7.4 percent. . . The bad economic news continues

to batter local consumer confidence, which has now fallen for 20 months

in a row. Local consumer confidence dropped by 49 percent in 2008 and is

down 64 percent from its all-time high reached in October 2004. . . Local

stock prices ended the year down more than 38 percent, which was worse than

the Dow Jones Industrial Average (down 34 percent) but better than the NASDAQ

Composite (down 41 percent). . . Despite a spate of negative news, the

national Index of Leading Economic Indicators registered its first increase

since April of last year. Whether this is aberration or a signal of a

possible turning point for the national economy remains to be seen, as

economists typically look for three consecutive changes in a leading index to

signify the latter.

December's

decrease puts the USD Index of Leading Economic Indicators for

San Diego County

at 108.4, down from October's

revised reading of 110.7. A revision in the national Index of Leading

Economic Indicators caused a revision in the value of the USD Index and the

previously reported change for October. Revisions in building permits and

local stock prices for November offset one another, but the value of the Index

for that month was revised upward from its previously reported value of 110.6.

Please visit the Website address given below to see the revised changes for the

individual components. The values for the USD Index for the last year are

given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|