|

Home

Leading Economic Indicators

Down in August

Note: The tentative date for the

release of next month's

report is October 28.

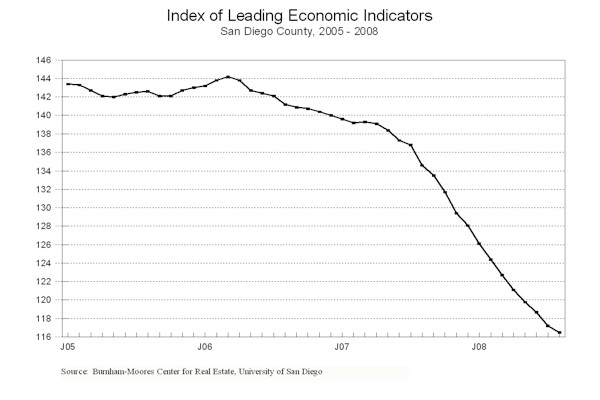

September 30, 2008 --

The University of San Diego's Index of Leading Economic Indicators for

San Diego

County fell 0.6 percent in

August. For the tenth straight month,

local consumer confidence was the most negative component.

Also down considerably were initial claims for unemployment insurance,

help wanted advertising, and the outlook for the national economy.

These were offset somewhat by large gains in building permits and local

stock prices. Although August's

drop was the 28th in 29 months for the USD Index, it was the smallest

monthly decline since May 2007.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (August)

Source: University of San Diego |

- 0.6 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (August)

Source: Construction Industry Research

Board |

+ 1.12% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (August)

Source: Employment Development Department |

- 1.41% |

|

Stock Prices

San Diego Stock Exchange Index (August)

Source: San Diego Daily Transcript |

+ 1.39% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (August)

Source: San Diego Union-Tribune |

- 3.03% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (August)

Source: Monster Worldwide |

- 0.81% |

|

National Economy

Index of Leading Economic Indicators (August)

Source: The Conference Board |

- 0.97% |

The outlook for the local economy

remains negative, with weakness expected through the first half of 2009 and

likely beyond. A big question mark

at this point is the impact on the local economy of the national financial

crisis. Due to the slump in real

estate, employment among the lenders in

San Diego County

through August was already down more than 2,500 compared to the same period in

2007. It remains to be seen whether

the recent mergers of institutions such as Merrill Lynch and Washington Mutual

will result in more job losses in the financial sector, or whether the

tightening credit markets will adversely impact local economic activity.

Highlights:

Despite the slump in the housing market, residential units authorized by

building permits were up for the third month in a row in August.

A surge in multi-family units authorized the last five months is largely

responsible for the unexpected rise. . . There was no relief on either side of

the labor market. Initial

claims for unemployment insurance and help wanted advertising were

negative for the 5th and 24th consecutive months

respectively. The net result was

that the local unemployment rate remained at a high 6.4 percent in August. . .

Once again, the raw data on local consumer confidence was positive but

the moving average trend continues downward.

It will be interesting to see the September data, as all the bad news on

the financial front occurred during that month, including the problems with

Fannie Mae, Freddie Mac, Merrill Lynch, Lehman Brothers, AIG, Washington Mutual,

and Wachovia, as well as the largest one-day point drop ever in the Dow Jones

Industrial Average. . . In the calm before the storm, local stock prices

staged a solid rebound in August. . . The national Index of Leading Economic

Indicators was down for the second month in a row as the national economic

news continues to be bad. The one

piece of good news was that the preliminary estimate of Gross Domestic Product

growth for the second quarter of 2008 was a solid 3.3 percent.

However, much of that growth was due to the stimulus checks that were

mailed to consumers during that quarter.

The employment situation remains bleak, with the national economy

shedding jobs in each of the first eight months of 2008 and the national

unemployment rate topping 6 percent in August for the first time since 2003.

August's

decrease puts the USD Index of Leading Economic Indicators for

San Diego County

at 116.5, down from July's

revised reading of 117.2. Revised data on the national Index of Leading Economic

Indicators led to revisions in both the USD Index value and the previously

reported change for June, while revisions in building permits and initial claims

for unemployment insurance affected the value and change for July.

Please visit the Website address given below to see the revised changes

for the individual components. The

values for the USD Index for the last year are given below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|