|

Home

Leading Economic Indicators

Up in April

Note:

The

tentative release date for next month's report is June 25.

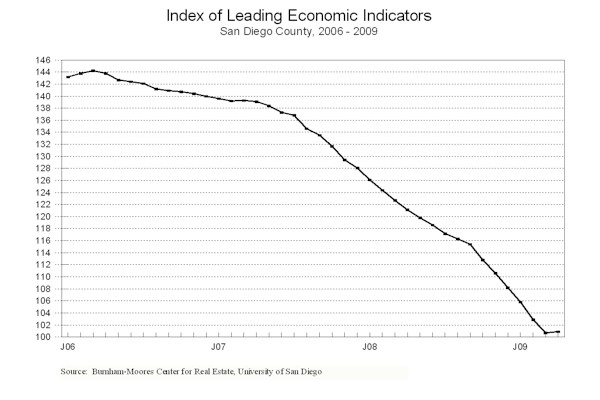

May 28, 2009 -- The University of San Diego's Index of

Leading Economic Indicators for San Diego County

rose 0.2 percent in April. A sharp

reversal in local consumer confidence, supported by solid gains in building

permits, local stock prices, and the outlook for the national economy, allowed

the USD Index to break a string of 24 consecutive monthly declines.

April also marked the first time since March 2007 that more components

were up than down. Not all the news

was positive, as initial claims for unemployment insurance and help wanted

advertising were both down sharply.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (April)

Source: University of San Diego |

+ 0.2 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (April)

Source: Construction Industry Research

Board |

+ 1.24% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (April)

Source: Employment Development Department |

- 2.66% |

|

Stock Prices

San Diego Stock Exchange Index (April)

Source: San Diego Daily Transcript |

+ 2.33% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (April)

Source: San Diego Union-Tribune |

+ 2.78% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (April)

Source: Monster Worldwide |

- 4.49% |

|

National Economy

Index of Leading Economic Indicators (April)

Source: The Conference Board |

+2.02% |

While caution needs to be

exercised about drawing conclusions from just a single month’s worth of data,

this is definitely good news at a time when there hasn’t been much about the

local economy. In addition to being down every month for two full years,

the USD Index had been down 35 out of the last 36 months, and last six months

were the six biggest monthly declines on record. Since economists

typically look for three consecutive moves in one direction for a leading index

to signal a turning point, it remains to be seen if a turnaround is in sight.

If it is signaled in the next couple of months, the timing looks to be towards

the end of this year or the first part of 2010. Even if a bottom is

reached, it is likely that the rebound from there will be weak. Indeed,

there could be a significant period where the local economy remains flat after

reaching that bottom.

Highlights:

Another solid month for residential units authorized by building permits

reversed a seven-month negative trend in that component. More residential

units were authorized in March and April than in the previous five months

combined, and it was the best two month total since July and August of last

year. . . As was mentioned earlier, the two labor market variables, initial

claims for unemployment insurance and help wanted advertising,

continued their negative slide. The net result was that the local

unemployment rate still remains at a high 9.1 percent, with the number of jobs

down 45,300 countywide in April compared to the same month last year. . .

Local consumer confidence registered the biggest one month turnaround ever

recorded by any component in the Index. Given that a one percent change in

any direction is considered a significant move, the shift from a decline of 3.27

percent in March to a gain of 2.78 percent in April represents a sea change in

consumer sentiment. This ends a stretch of 23 straight monthly decreases

in local consumer confidence, almost every one of which was a significant drop.

The San Diego Union-Tribune reports that, while the current outlook

remains relatively unchanged, consumers have become much more positive about

their future prospects. The key to turning things around is if this

increased consumer confidence translates into increased purchases, particularly

of bigger ticket items such as houses and automobiles. . . Local stock prices

rallied with the rest of the financial markets off of the lows reached in

March. . . The national Index of Leading Economic Indicators had its

first increase in a year, and it was the strongest gain since June 2005.

As is the case with the local index, more data is needed before a trough in the

national economy is signaled.

April’s decrease puts the USD Index of Leading Economic Indicators for San Diego County

at 100.9, up from March’s reading of 100.7. Revised data for building

permits and the national Index of Leading Economic Indicators led to a revision

in the values of the USD Index for November through February and revisions in

the previously reported changes for November and February. Please visit

the Website address given below to see the revised changes for the individual

components. The values for the USD Index for the last year are given

below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|