|

Home

Leading Economic Indicators

Up Slightly in July

Note:

The

tentative release date for next month's report is September 29.

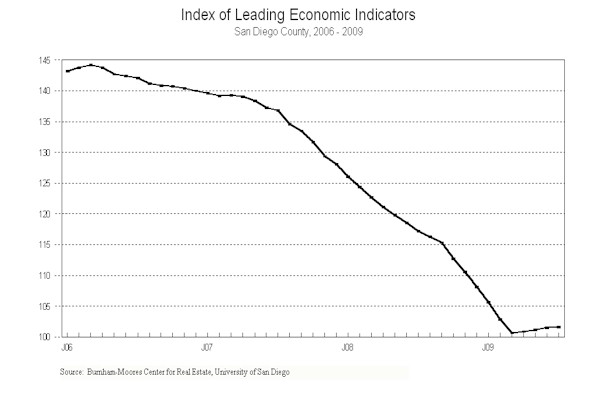

August 27, 2009 -- The University of

San Diego's Index of Leading Economic Indicators for San Diego County rose 0.1

percent in July. A strong gain in local consumer confidence, a lesser but still

significant one in the outlook for the national economy, and a small increase in

local stock prices was enough to push the Index to its fourth consecutive gain.

On the downside, initial claims for unemployment insurance hit record levels,

help wanted advertising remains down significantly, and building permits turned

slightly negative.

|

Index of Leading Economic

Indicators

The index for San Diego County that

includes the components listed below (July)

Source: University of San Diego |

+ 0.1 % |

|

Building Permits

Residential units authorized by building

permits in San Diego County (July)

Source: Construction Industry Research

Board |

- 0.18% |

|

Unemployment Insurance

Initial claims for unemployment insurance in San Diego

County, inverted, estimated (July)

Source: Employment Development Department |

- 2.59% |

|

Stock Prices

San Diego Stock Exchange Index (July)

Source: San Diego Daily Transcript |

+ 0.12% |

|

Consumer Confidence

An index of consumer confidence in San

Diego County (July)

Source: San Diego Union-Tribune |

+ 2.99% |

|

Help Wanted Advertising

An index of online help wanted advertising in

San Diego (July)

Source: Monster Worldwide |

- 1.15% |

|

National Economy

Index of Leading Economic Indicators (July)

Source: The Conference Board |

+1.18% |

The outlook for San Diego's economy

remains cautiously optimistic. As has been mentioned previously, the bottom is

projected to be reached in the first half o 2010. Some economic variables are

likely to turn up before then, but job losses are expected to continue for the

rest of this year. 2009 is shaping up to be the worst year ever for San Diego

County in terms of net employment loss, with the job loss for July compared to

July 2008 topping 55,000. The hardest hit sectors include construction (down

10,400 jobs), leisure and hospitality (-9,300), administrative, support, and

waste services (-9,200), retail trade (-8,000), and manufacturing (-7,700). The

only positive sector for job growth was in healthcare, but only 800 jobs were

created in that industry in the last year. Employment will be among the last

economic indicators to rebound as employers have squeezed productivity gains out

of their workers and will be reluctant to expand their workforces unless they

are absolutely certain that a recovery has taken hold.

Highlights: A modest rebound in residential units authorized by

building permits came to an end as that component fell for the first time in

four months. Only 177 residential units were authorized in July, which was the

third worst total ever, topped only be the abysmal numbers in January and

February of this year. . . Both labor market variables remain under pressure.

Initial claims for unemployment insurance hit a new all-time high,

topping the 38,000 mark in July. Hiring remains at depressed levels, although

the decline in help wanted advertising was the smallest since September

2008. The net result was that the local unemployment rate increased to 10.3

percent in July. . . The trend in local consumer confidence continues to

be positive compared to the end of 2008 and the beginning of this year. The key

to a rebound is whether and when this increased confidence translates into

greater consumer spending and housing sales. . . Local stock prices

advanced for the fourth month in a row, although the gain was relatively small

compared to recent months. . . The national Index of Leading Economic

Indicators also rose for the fourth consecutive month. While the Gross

Domestic Product (GDP) fell in the second quarter of 2009, the annualized change

of -1.0 percent was much lower than the 5.4 percent and 6.4 percent drops in the

fourth quarter of 2008 and the first quarter of this year respectively. Look

for GDP growth to turn positive in the third quarter.

July's

decrease puts the USD Index of Leading Economic Indicators for San Diego County

at 101.7, up from June's reading of 101.6. There were revisions to the national

Index of Leading Economic Indicators for April and May, but they did not affect

the percentage change or the previously reported level of the USD Index. Please

visit the Website address given below to see the revised changes for the

individual components. The values for the USD Index for the last year are given

below:

For more information on the University of San Diego's Index of Leading

Economic Indicators, please contact:

|